Buy Now, Pay Later companies are gaining ground in Latin America, with Kueski reporting more than 1 million customers.

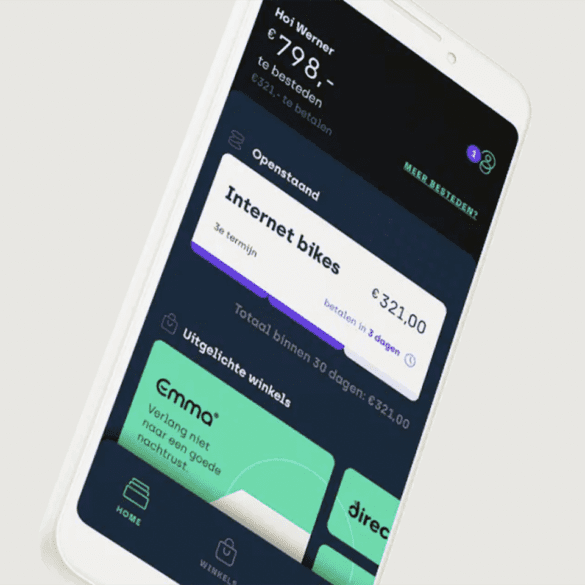

In the Netherlands, BNPL company In3 has been a part of this growth and is now set to expand into other markets.

When we really started covering financial inclusion and financial health here at LendIt five years ago it seemed that we...

On Episode 32, I talk with Neal Desai of Kafene. Kafene is a mission-driven company with the goal of empowering...

Buy Now Pay Later is taking off in Latin America as an alternative for short-term financing and financial inclusion.

Buy Now Pay Later startups in Latin America could provide a way for lenders to finally reach the underbanked.

Identiq provides a higher level of risk analysis for buy now, pay later (BNPL) customers by leveraging tech that has been around for decades.

There are a number of fintech themes coming out of 2021 that will have a dramatic impact on the industry in 2022. Here are our top seven trends: Buy now pay later, fintechs going public, overdraft fees, embedded finance, cash flow underwriting, CBDCs and Web3.

Walia sees plenty of activity in BNPL, beginning with brands partnering with banks to introduce their BNPL capability.

LendIt Fintech has teamed up with leading fintech firm Amount to put together a survey asking banks and fintechs about launching a BNPL credit product.