On the second day of the Fintech Nexus USA conference, Nubank's David Vélez recounted in direct terms the multi-year overnight success.

Here are the most read news stories from our daily newsletter today: The Clearing House On The Race for Real-Time...

Forbes partnered with market research firm Statista to measure the best banks in more than 20 countries by surveying more...

The Linux Foundation has agreed to acquire the Fintech Open Source Foundation (FINOS) and will allow the group to operate...

Automated digital assistants has become must have in financial services as more banks have started to roll out products to...

As the sparkling firecracker news of acquisitions, plans, and partnerships in the BNPL space fizzle, oversight reporting has sprung up. A Credit Karma survey found that of those who used BNPL, more than half of the younger crowd missed at least one payment.

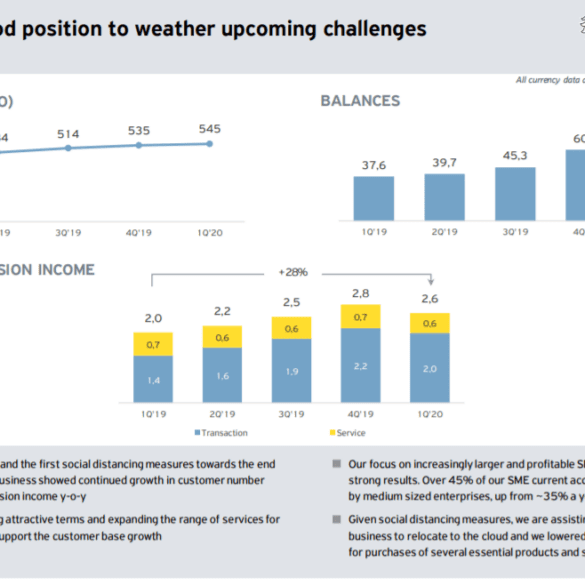

Oliver Hughes is the CEO of Tinkoff Group, one of the world’s most successful digital banking groups with over 10 million customers. This is one our most interesting conversation to date, full of fantastic operating advice.

Tinkoff is publicly listed with a $3.8 billion market capitalization, which brings clarity to its operating model in a time when many noteworthy consumer digital banks are pursuing customer acquisition at the expense of profitability.

Oliver has led Tinkoff through three financial crises, and brings experience and perspective to the current COVID crisis. This is a fascinating discussion about unit economics in digital banking and winning business models with a CEO with thirteen years of experience in this space.

Nigel Morris previously co-founded and served as president and COO of Capital One; Morris is now an VC at QED...

A new survey by Cornerstone Advisors examined six questions about consumers primary financial institution and found some interesting trends amongst...

Some banks have recently started automatically increasing credit card limits for customers; the credit card companies hope that doing so...