With a message on Twitter and complaints of locked accounts, Crypto.com announced it was the first significant exchange hacked in 2022.

This earnings season started strong but turned uneven this week. Even firms that showed outsized growth saw their stock prices...

In this conversation, we chat with Tim Frost, CEO and Co-Founder of Yield App, a fintech app making DeFi accessible to everyone. Prior to founding Yield, Tim helped build 2 previous digital banks, Wirex and EQIBank. Tim has also helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, and many others.

More specifically, we touch on all things crypto banking and debit cards, crypto onramps, juristictions and regulation, defi banking, yield generation mechanisms, and so much more!

Gensler said his biggest worry about the equity market was competition and consolidation. While retail investing has taken off, the PFOF that enables it is ripe for conflict of interest.

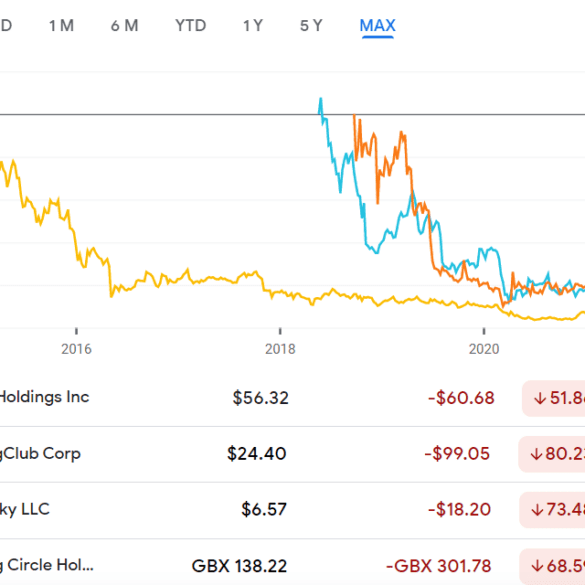

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

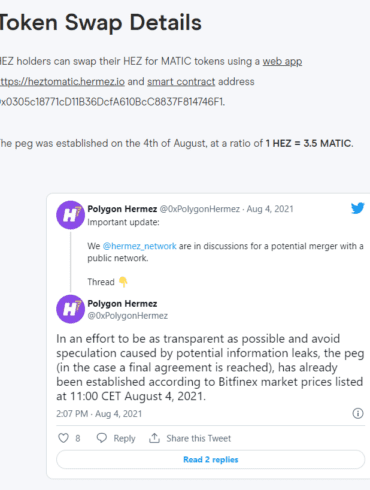

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

Investors will be able to gain exposure to bitcoin through the fund, without direct exposure to the volatile currency that traded over $62,000 over the weekend alongside this and other pro-crypto news. On Tuesday morning, the ProShares ETF went live under the ticker BITO at around $40.

·

That kid who created his own $400,000 NFT project, Benyanub Ahmed, joined another successful NFT group. Together, their sales volume moved past the $5 million mark after just three weeks.

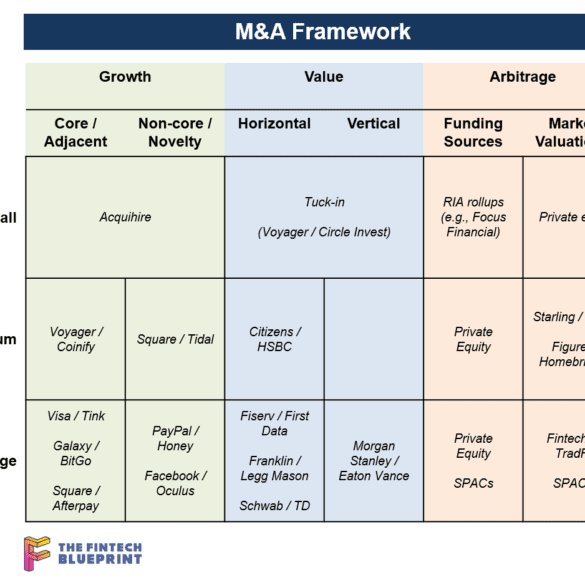

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

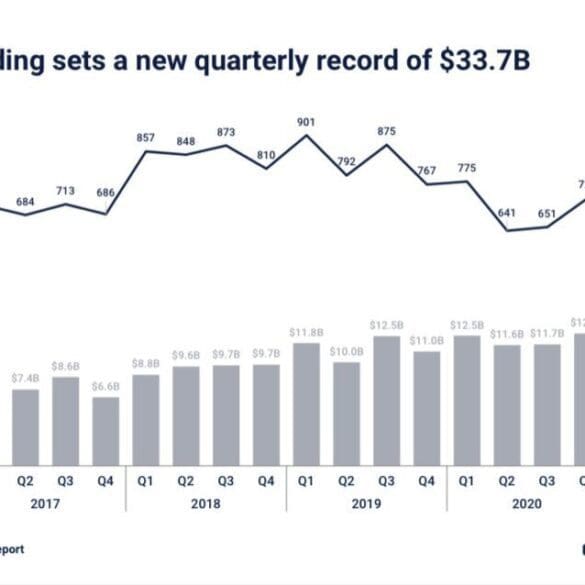

Last quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.