CoinDesk is releasing their 2020 version of the CoinDesk 50, the most innovative, consequential and viable projects in the blockchain...

ValueWalk has analyzed the recent CB Insights report on fintech funding as well as the Forbes 50 report on the...

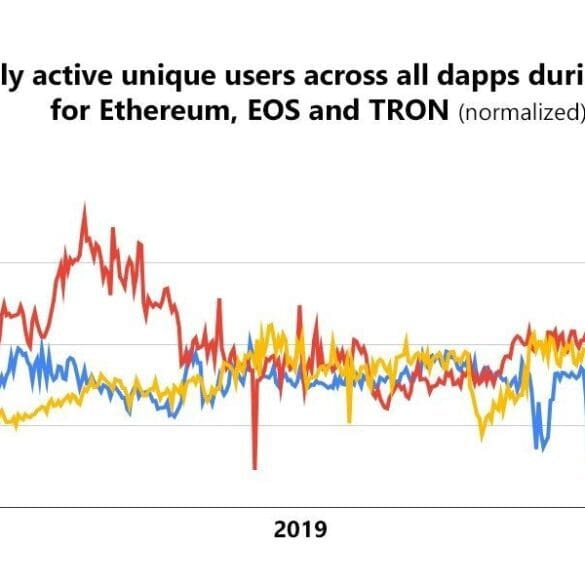

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

The fintech company is partnering with crypto exchange Coinbase to allow their members to purchase cryptocurrencies; it is expected to...

Fintech funding reached $11bn in 2018, a 38 percent jump year over year; banking startups focused on customer data, trade digital...

A digital world needs digital money, and a few influential players are actively working to build it. China's BSN initiative and Facebook's Libra embody the East's public sector led approach to building and owning the internet of value and the West's private sector led (and public sector challenged) attempt at cheaper commerce on the web. While the nature of the approaches may be different, the data and privacy considerations are eerily similar. For all of our past episodes and to sign up to our newsletter, please visit bankingthefuture.com. Thank you very much for joining us today. Please welcome Lex Sokolin.

Figure, the blockchain-based fintech lending startup founded by Mike Cagney, has a new president; Asiff Hirji was the former president...

The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

XRP is the third largest cryptocurrency by market capitalization; it will be added to Coinbase Pro in transfer-only mode which...

Cryptocurrency exchange Coinbase and payments company Ivy Koin have met with FDIC officials in recent weeks to explore obtaining a...