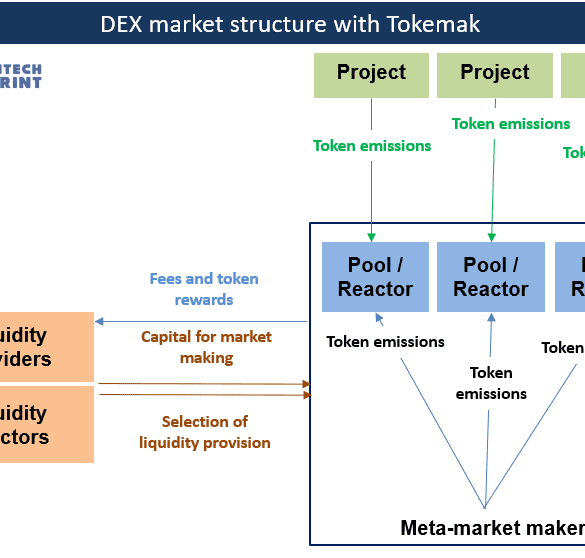

This week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.

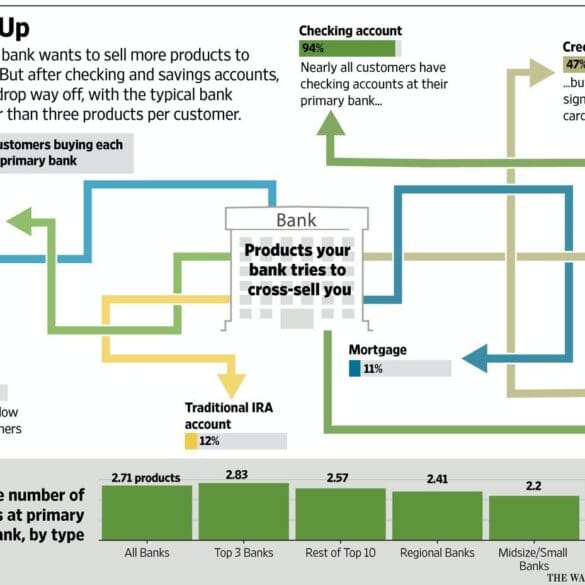

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

central bank / CBDCCryptodecentralized financeopen sourcephilosophyregulation & compliancestablecoins

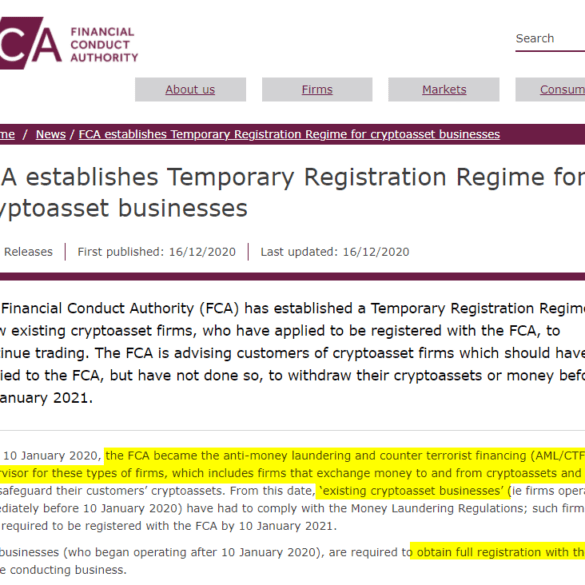

·This week, we look at:

Proposed US regulation from FinCEN, legislation from the House of Representatives, and UK FCA registration requirements that would impact the crypto industry

The difference between competition for share within an established market, and competition between market paradigms (think MSFT vs. open source, finance vs. DeFi)

The crypto custodian moves from BBVA, Standard Charters, and Northern Trust

The bank license moves from Paxos and BitPay, as well as the planned launch of a new chain by Compound, in the context of the framework above

Permissionless finance is a paradigm breach. It pays no regard for the very nature of the incumbent financial market. Without banking, it creates its own banks. Without a sovereign, it bestows law on mathematics and consensus. Without broker/dealers, it creates decentralized robots. And so on. It tilts the world in such a way as to render the economic power of the incumbent financial market less important. Not powerless -- the allure of institutional capital is a constant glimmer of greedy, opportunistic hope. But the hierarchy of traditional finance does not extend to DeFi, and thus has to be re-battled for the incumbent. This is cost, and annoying.

This week, we look at:

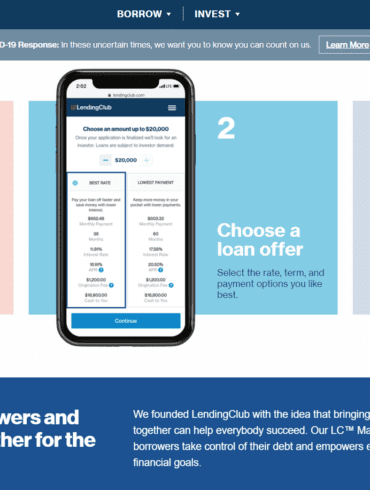

Lending Club, the peer-to-peer lending innovator, turning off peer-to-peer lending after having a bank in its pocket

Consolidation of the UK's largest crowdfunders, CrowdCube and Seedrs, and their limited economics

The scale of the Morgan Stanley and Eaton Vance deal, creating a $1.2 trillion asset manager

The struggle of peer-to-peer models more generally, and whether the blockchain movement can overcome the Prisoner's Dilemma

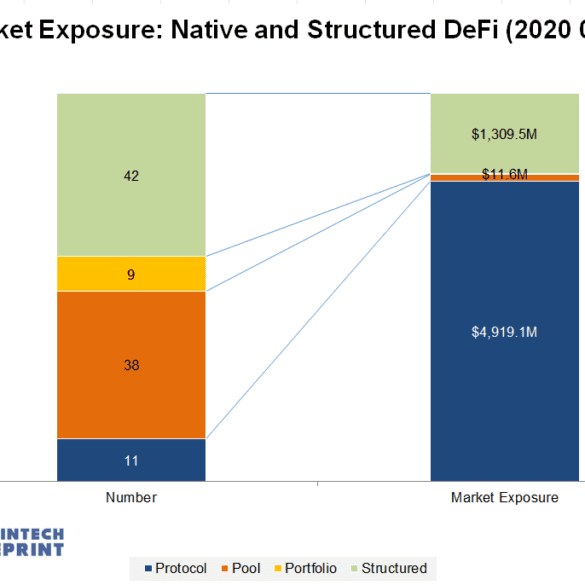

This week, I grapple with the concepts of financial centralization and decentralization, anchoring around custody, staking, and DeFi examples. On the centralized side, we look at BitGo's acquisition of Lumina, Coinbase Custody and its similarity to Schwab and Betterment Institutional. On the decentralized side, we examine the recent $500 million increase in value within the Compound protocol, as well as the recursive loops that could pose a broader financial risk to the ecosystem.

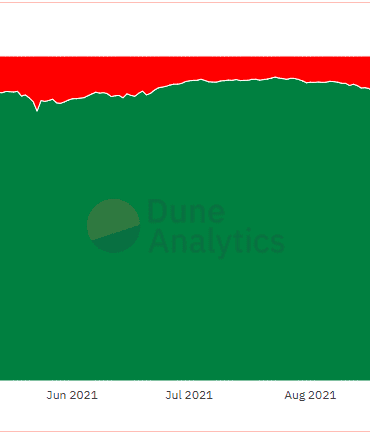

Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

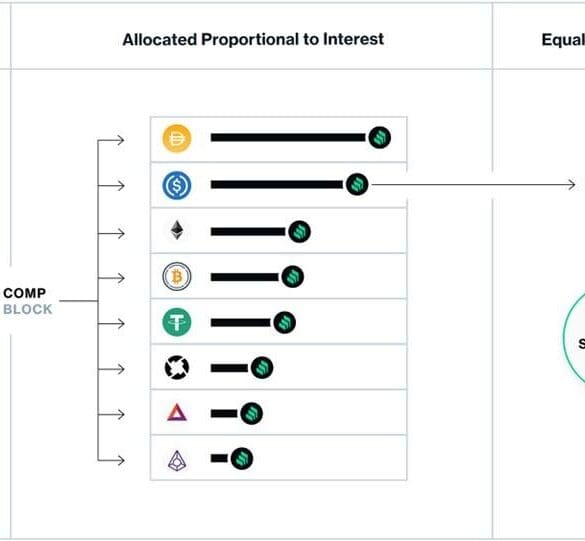

In this conversation, we talk with Robert Leshner of The Compound Protocol about the early days of crypto and how a fascination with Ethereum smart contracts drove him to build one of the largest DeFi projects to date.

Additionally, we explore the nuances of lending and interest rates, consumer privacy software and data monetization, floating interest rate pools of capital across different token pairs, DAO evolution and its influence on mechanism design, the role Compound plays in chain interoperability, and the discovery of yield farming as a means for user incentivisation.

This week, we look at:

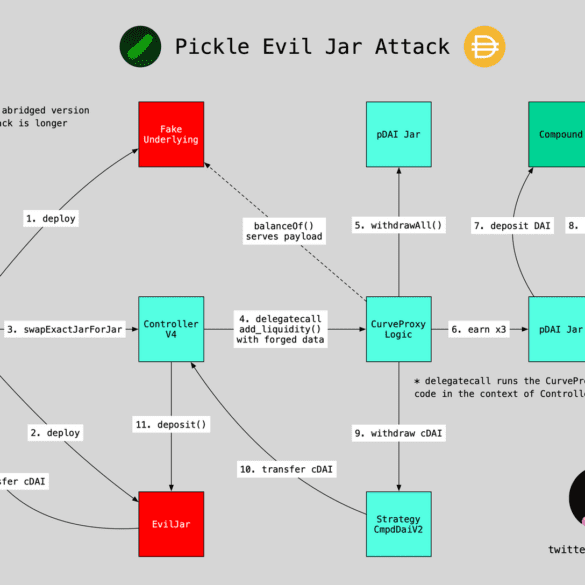

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

WhatsApp, Brazil Central Bank In Talks To Restore Payments Service Volcker Rule reforms expand options for raising VC funds CMG...

Wirecard seeks new financing strategy as Moody’s downgrades firm to junk Compound Tops MakerDAO, Now Has the Most Value Staked...