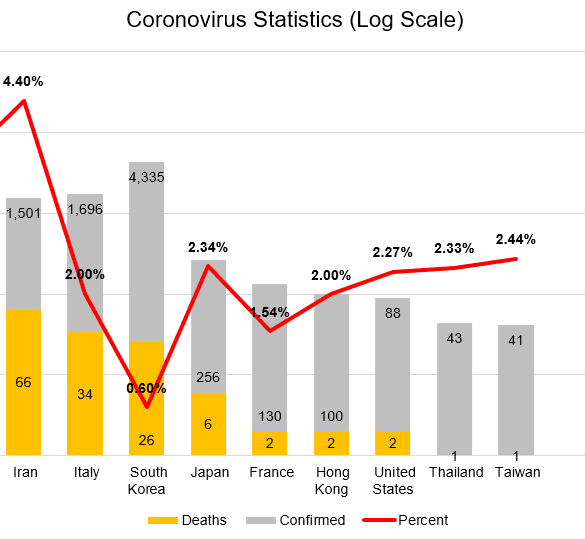

I look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low -- but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that's what the conspiracy theorists want you to think!

With Credit Karma in the news this week, we thought we would revisit a keynote given by CEO Ken Lin...

In his weekly Forbes column Ron Shevlin of Cornerstone Advisors wonders if Intuit is the best fit to buy Credit...

Over the weekend we learned that Intuit, the makers of TurboTax, Mint and Quickbooks, is close to acquiring Credit Karma,...

ValueWalk has analyzed the recent CB Insights report on fintech funding as well as the Forbes 50 report on the...

In this week’s PeerIQ Industry Update they cover the growing turmoil in the markets due to the spread of coronavirus...

The year has started out strongly for fintech M&A with four significant deals announced in just the first two months;...

Ken Lin started Credit Karma back in 2007; since then the company has attracted 100 million members and brought in...

We start out the week with yet another blockbuster fintech acquisition. The Wall Street Journal reported late Saturday that Intuit,...

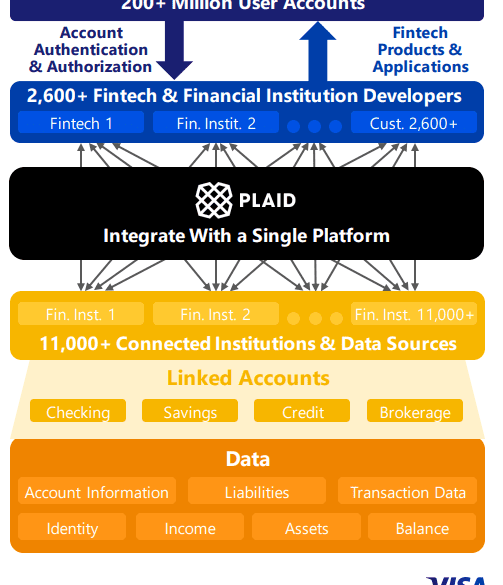

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.