Stuart Sopp is the CEO and Founder of Current, one of the fastest-growing digital banks in the country. But what is most interesting is how he built this bank, thinking about the crypto opportunity every step of the way.

According to 2017 data from the FDIC 47 percent of Black Americans were underbanked, compared to 20 percent of white...

Wirecard seeks new financing strategy as Moody’s downgrades firm to junk Compound Tops MakerDAO, Now Has the Most Value Staked...

Current is a New York-based digital bank with around 800,000 customers, many of whom live paycheck to paycheck; they have...

One of the biggest benefits presented by fintechs is their ability to serve customers big banks normally would ignore; with...

Mobile bank Current launches a points rewards program for debit card users U.S. Financial Service Buckle Secured $31 Million Through...

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

When the world went into lockdown the digital banks were one of the beneficiaries of everyone staying at home; Current...

New research from Apptopia shows that the leading digital banks in Europe are off to a slow start in the...

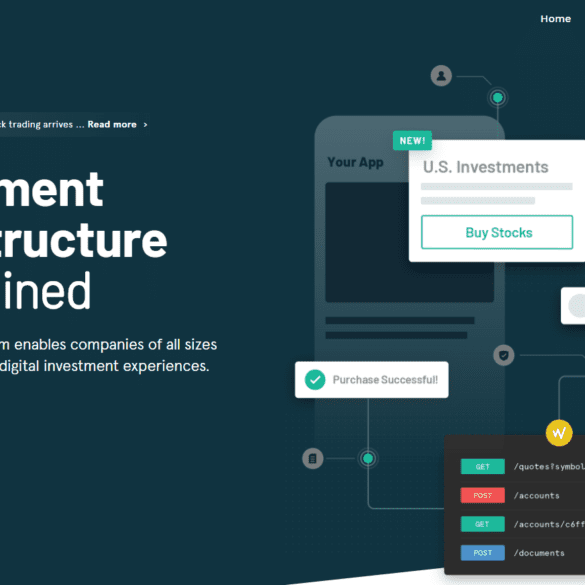

I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?