Just in time for the holiday shopping season, payments app Curve closed on a $1 B credit facility deal to fund loans across UK, EU, and US.

This week, we look at:

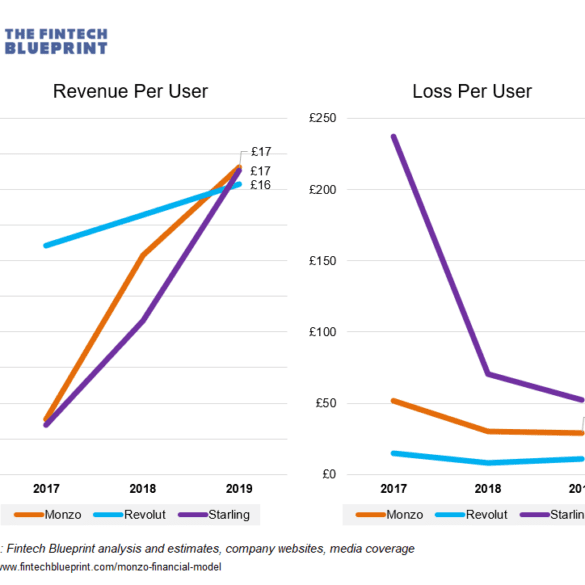

The financial model behind Monzo, and comparisons to Revolut and Starling

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

Facebook Financial forming to take over payments and commerce

London-based fintech Curve is in the market for a new equity round that is rumored to be between £100 million...

Last month as Wirecard was unraveling the UK’s Financial Conduct Authority temporarily suspended Wirecard Card Solutions (WCS) from operating; this...

Today, the UK financial regulator, the Financial Conduct Authority, has suspended the activities of Wirecard’s UK subsidiary; this is having...

The CEO and Head of US operations for Curve discuss financial super apps, BNPL, launching in the US, credit cards and more

UK payment aggregator Curve is launching its own credit offering later this year called Curve Credit; they began testing the...

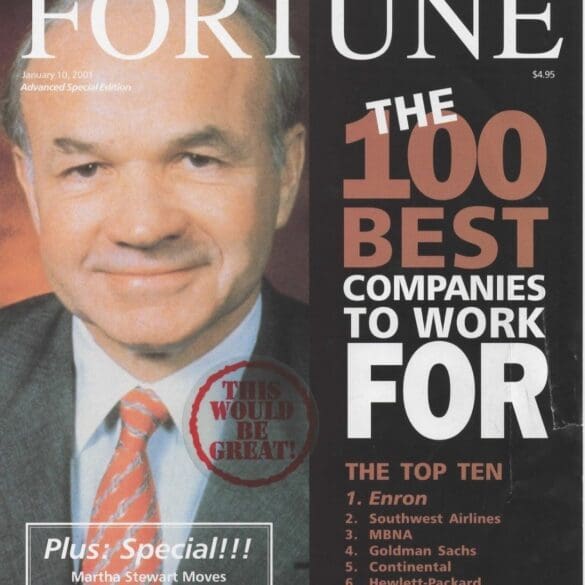

This week, we consider the impact of financial infrastructure collapse and who really gets hurt through the lens of Wirecard, Enron, and Lehman Brothers. Yes, there are investors in the entity that will lose value. But there are also clients and counterparties of Wirecard, like Curve, Revolut, and Crypto.com. In the case of Lehman, there was a $40 trillion derivatives notional amount that took twenty years to wind down. We also consider the most recent $500,000 hacking in DeFi of an automated market maker to see if there are common threads to be drawn between the two worlds.

London-based fintech Curve has been selected by Samsung to power the Samsung Pay Card in the UK; the debit card,...