The resumption of private student loan repayments provides an opportunity for financial institutions to provide better tools to help with debt management.

TransUnion's latest quarterly study found most Americans could be experiencing a 'personal recession' with 54% stating their incomes were not keeping up with inflation.

One curious solution to the problem that wouldn't involve Congress: have the Treasury mint a trillion-dollar platinum coin and hand it to the government.

US credit card debt was $870 million as of December 2018 according to data from the Federal Reserve, an increase...

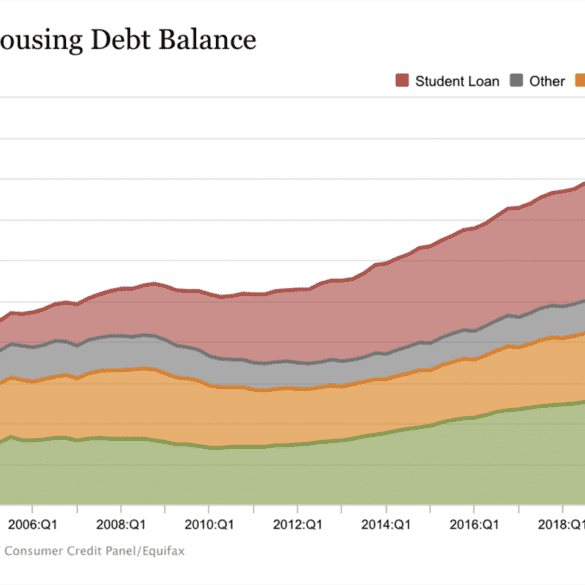

Credit-card debt has grown to record highs and some large banks are reporting increased delinquency rates; this trend, combined with higher interest rates could be cause for concern according to Michael Pearce, an economist at Capital Economics; article provides data from the NY Fed on delinquent loans across student, auto, mortgage and credit card debt. Source

In the Financial Health Network's recent report it was found economic conditions are "disproportionately" affecting vulnerable households.

A New York Fed report shows Americans leaned heavily on their credit cards in June to offset growing financial pressures from inflation.

YieldStreet is a unique fintech company in the US, providing access to unique investment opportunities such as litigation finance, marine...

CommonBond focuses on helping those with student loans better manage their debt. Earlier this week they released an interesting study...

The American Bankers Association released their quarterly delinquency bulletin which shows steady delinquency rates at 1.56%; the 15-year average is 2.16%; Household debt hit a record $12.84 trillion in the second quarter with increases in automobile, mortgage and credit card debt. Source