Raisin is one of the most successful European fintech platforms having raised more than $200 million in equity capital from...

A recent research note from Bank Policy Institute shares how big and smaller banks are fairing in the fight for...

Loan demand has increased in recent quarters and now banks find themselves struggling to gain enough deposits to match the...

Customers are becoming more demanding as interest rates climb; the average interest rate paid by the biggest US Banks jumped to 0.40% in the third quarter; sophisticated customers are now reconsidering where they hold their cash accounts; Fifth Third is one bank that is raising rates for these types of customers; wealth management deposits have decreased at Bank of America, JP Morgan and Wells Fargo in the third quarter according to Autonomous Research. Source

Until last month it was unknown how SoFi, the most successful fintech firm in the US, was going to offer...

Citi is the world’s biggest credit card issuer and boasts over 28 million clients; while the card business is strong,...

In just three months the digital bank has brought in £5.4 billion of deposits across 100,000 customers; the savings account...

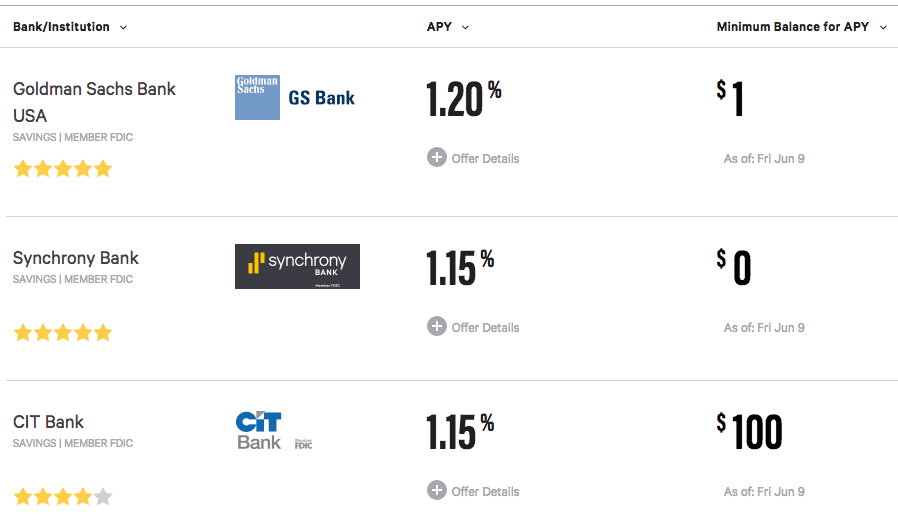

Lloyd Blankfein recently presented at the Credit Suisse 19th Annual Financial Services Forum; Blankfein shared that Marcus has access to over $17 billion in deposits; since the acquisition of GE Capital, retail deposits have grown 90% which gives allows them to access cheap capital; Goldman plans to grow consumer products offered through Marcus. Source

Raisin is looking to expand on their deposit marketplace by offering a term deposit product to European SMEs; this will allow SMEs to earn money on their cash instead of dealing with negative interest rates that have been prevalent across Europe; currently Raisin has enlisted Banco BNI Europa from Portugal, Younited Credit from France and Greenhill Bank from Germany in the product. Source.

I noticed this report in Forbes last week which discussed a recent increase that Goldman Sachs was making on their...

No More Content