Checkout.com has raised a $150mn series B round which triples their valuation to $5.5bn; the round was led by Coatue,...

We look at some of the recent Fintech bundling news that boggle the mind. Neobank Chime just raised a mammoth round from DST Global, valuing it at $6 billion. Figure raised another $60 million round. Goldman is launching a retail roboadvisor. Revolut is offering pensions. Wealthfront is offering mortgages. The world is upside down. We cool down with pictures showing augmented reality implementations in commerce and finance, and finish with an elevated thought about the future.

American Banker reports that digital banking startup Chime is close to raising $300mn in fresh capital; DST Global is said...

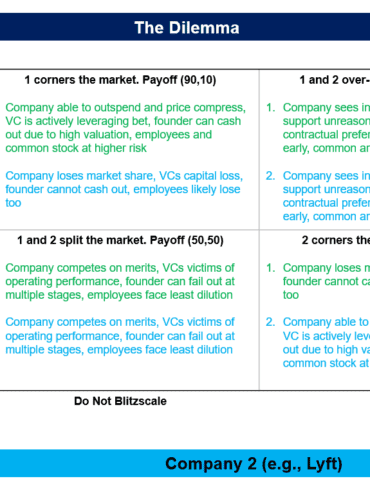

Why are high valuations bad? You've heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it's just a bunch of angry bees trying to find something to sting.

London based Checkout.com has raised a record $230mn series A round, it was the largest early stage round for a...

The Wall Street Journal reports a new fundraising round led by DST Global will value the company at more than $5bn; the last valuation was about $1.3bn in 2017; popularity in the app has since jumped when it expanded to include cryptocurrencies bitcoin, ethereum and litecoin; since launching they have reached more than 4 million users and the new valuation will put them in the top 15 of highest valued private tech companies in the U.S. Source.