In the face of global warming projections, investment becomes critical. ICE have released bond indices to support net-zero objectives.

Helios, raised $9.4 million in a recent seed round, news that has encouraged the industry to think about broader ESG issues.

The rising trend of ESG investment is wrought with confusion and misunderstanding. In the face of rampant greenwashing, regulators are finally starting to react.

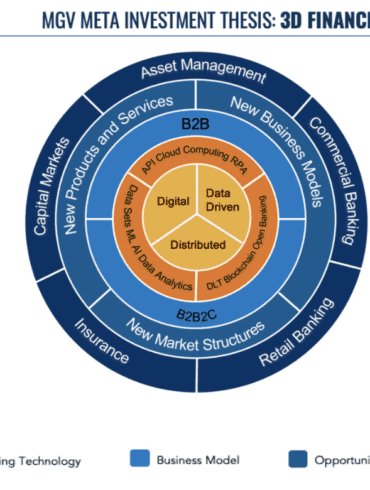

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who's the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

[Editor’s note: This is part of a series of articles we are publishing from Wharton Fintech ahead of LendIt Fintech...

Global warming's associated effects are posing an increased risk to financial institutions worldwide. The Basel Committee has issued guidelines to help mitigation

On episode 50 I talk with Chris Peacock of Aquaoso, a climate fintech providing data, analytics, and risk reports to financial institutions.

central bank / CBDCChinacivilization and politicsCryptoDAOsdecentralized financegovernanceIndiamacroeconomicsMetaverse / xRregulation & compliance

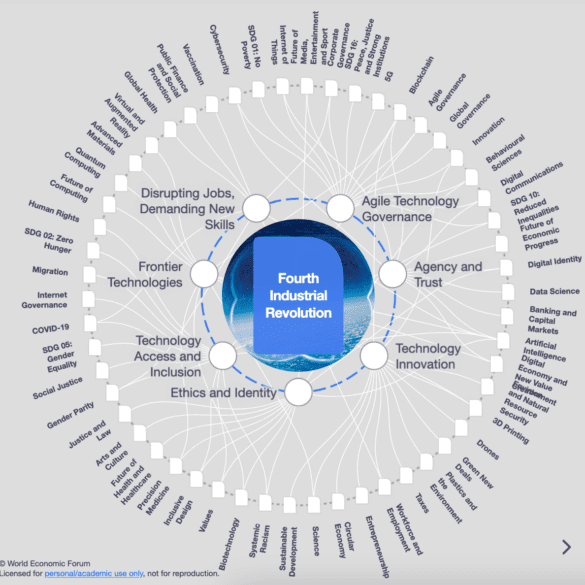

·In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

There is a huge multi-trillion dollar asset class that few investors have any exposure to but we literally rely on...

No More Content