This week Isabelle sat down with Alex de Vries, founder of Digiconomist to talk about the environmental impact of crypto currencies.

In the wake of the eth merge, speculation of skyrocketing value has been forgotten, and a divide in the community gaped open.

The industry's decision-makers, influencers, and traders will play an essential role in the future of ethereum and the industry.

This podcast features podcaster and author Laura Shin. She discusses the crypto space and her new book called The Cryptopians about the founding story of Ethereum and the ICO craze of 2017.

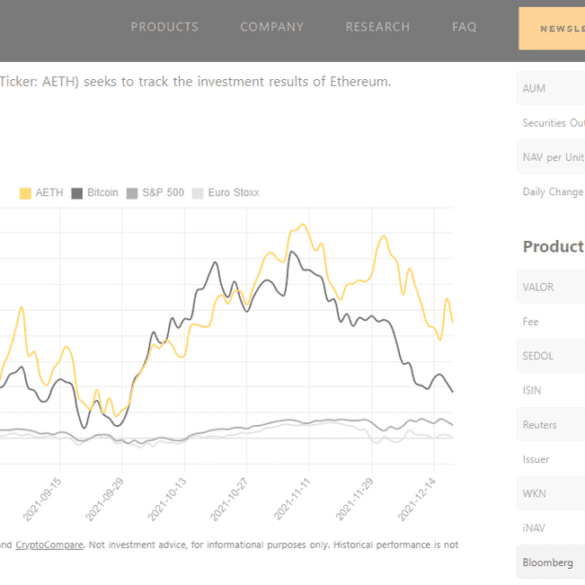

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

The proper definition of cryptocurrencies has stumped US regulators, many believe it has affected development. This year could bring clarity.

The crypto world was buzzing with the news of ethereum's successful shift to PoS. But what actually is staking? And why is it significant?

As ethereum's merge looms closer we asked the digital asset community what they felt about the shift from PoW to PoS.

Fueling a renewed bull run, Ukraine used crypto to raise funds, while Russians bought crypto to evade their currency's collapse.

digital transformationEmbedded Financeenterprise blockchainexchanges / cap mktsmega banksneobankOpen Bankingopen source

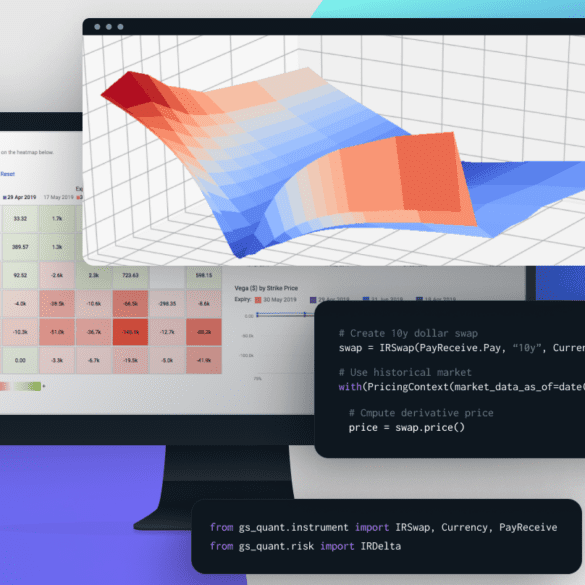

·In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.