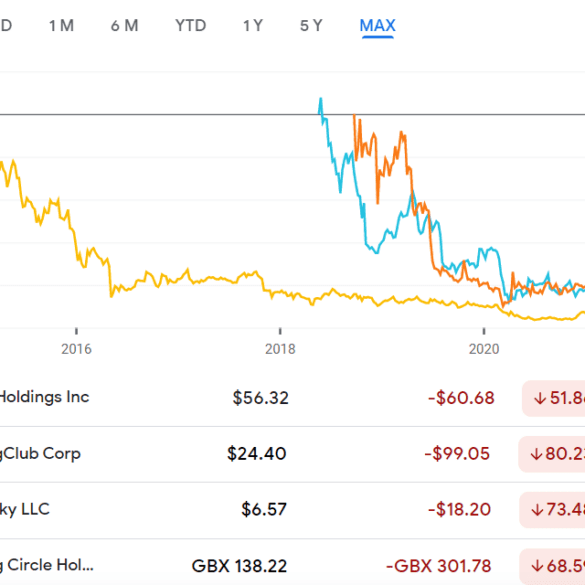

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

This week, we look at:

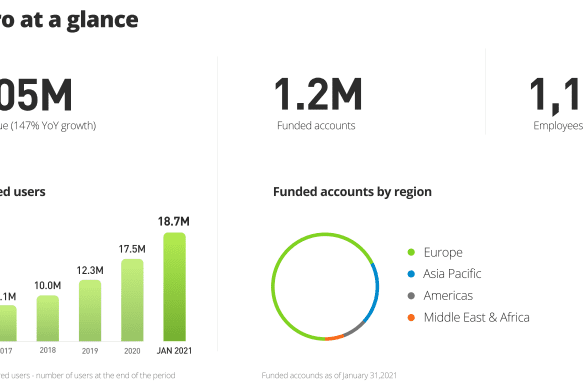

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

Cloudvirga Raises $50M in Series C Funding Student Loan Genius Raises $3.5M in Seed Series Prime Financing HSBC Partners with...

In this conversation, we talk all things capital markets and investing with Yoni Assia, the founder and CEO of eToro, one of the fastest-growing and largest global digital investing companies, brokerages, and applications out there.

More specifically, we discuss the eating habits of Warren Buffet, community-driven investment challenging incumbent investing practices, the purposes of investing and trading, of financial health, of investment education, of gamification of investment strategy, of capital markets and GameStop and the connection between capital, memes and fashion, and finally machine learning’s influence of investment behaviour.

Banks call on Congress to freeze new ILC approvals How the pandemic is propelling Zelle With Robinhood’s UK launch delayed,...

Qwil’s Johnny Reinsch: ‘Our mission is to provide liquidity to SMBs and freelancers around the world’ Nationwide Announces New Partnership...

eToro partnered with CoinDash to develop a set of social trading products built on blockchain technology; eToro CEO Yoni Assia tells Banking Technology, “With thousands of new coins in the market, it can be difficult for mainstream investors to navigate this new space. The CoinDash team is enabling users to better analyse their investments in cryptocurrencies, and to learn from others.”; the eToro marketplace has more than 4.5 million users in over 170 countries, they allow users to trade based on copying or following other individual’s portfolios and recently added access to cryptocurrencies. Source.