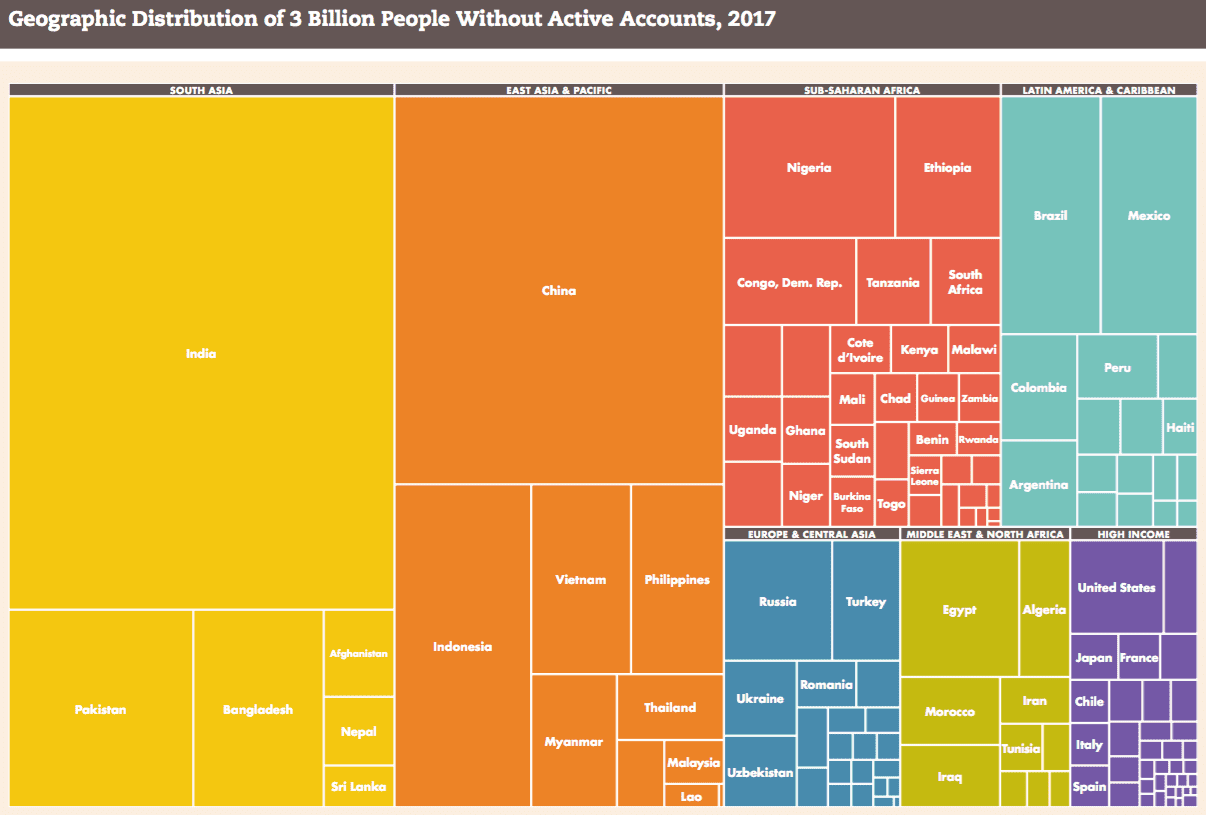

A few weeks ago the World Bank released the triennial Global Findex Database for 2017. We covered the release on...

The CEO and Founder of Juvo shares how he plans to bring billions of unbanked people into the financial system for the first time. Source

Watch live today at 2:30pm ET as LendIt Fintech International Innovator of the Year award winner Imad Malhas, CEO, IrisGuard talks about financial inclusion, technology, and refugees at the World Bank Group Meetings. Source.

PayPal’s CEO Dan Schulman has written an article in the Wall Street Journal; he believes that while technology generally has improved the lives of many, the potential of applying technology to expanding financial services is still unrealized; most people manage their money the same way they did years ago and fees paid by Americans still total $170 billion every year; Schulman believes that collaboration is key to achieving universal financial health. Source

Many people around the world still lack access to formal financial services and a financial identity; using a smartphone as a means to provide a financial identity is the best place to start when it comes to financial inclusion; article discusses why financial identity matters and the idea of communication as a commodity using data from data scientists at Juvo. Source

There still remains millions of people in developed countries like the UK and US who remain outside the traditional banking...

In 2011 the World Bank released the first ever Global Findex Database as “the world’s most comprehensive data set on how...

It has been said many times that the majority of Americans don’t have enough in savings to cover a $500...

Low wage workers have always had a difficult set of expensive options when they try to cash their paychecks; bank accounts are costly because they cannot maintain certain balances and check cashing shops are not exactly cheap; WiseWage, a North Carolina based non profit is looking to offer another option; the company has struck partnerships with Regions Bank and Varo Money, among others, to offer a lower cost direct deposit; the prepaid cards have set fees which can be waived if enough is loaded each month; the program is meant as a test to see if they can enlist those who have dropped out of the financial system because of a lack of options. Source.

The Center for Financial Inclusion (CFI) has released a report discussing financial inclusion partnerships between financial institutions and fintech companies; findings from the report were generated from 24 in-depth interviews with individuals leading financial inclusion in the industry and highlights 14 financial inclusion partnerships identified by CFI as best-case scenarios; the partnership case studies cover four financial inclusion challenges including: access to new market segments, new offerings for existing customers, data management, and deepening customer engagement and product usage. Source