Business considerations may prevent large banks from tackling financial inclusion, but the tech supporting inclusion program exists.

The desire for increased financial inclusion is a primary driver behind the increased use of alternative data in lending decisions, a new report from LexisNexis Risk Solutions finds.

A report from LexisNexis Risk Solutions finds that financial institutions prioritize transparency and inclusion but face challenges.

Sawa Credit is creating a community debt servicing technology platform to help the underserved stay in their homes.

Despite fintechs making inroads, a recent survey shows inclusion progress has not been as swift as expected, especially for women.

In Plend's recent Report, solving the ongoing cost of living crisis was considered critical as the situation deteriorates further.

In this episode we talk with Shivani Siroya, the CEO and founder of Tala. Tala is focused on delivering financial services to the underserved across the developing world, they are a true fintech success story.

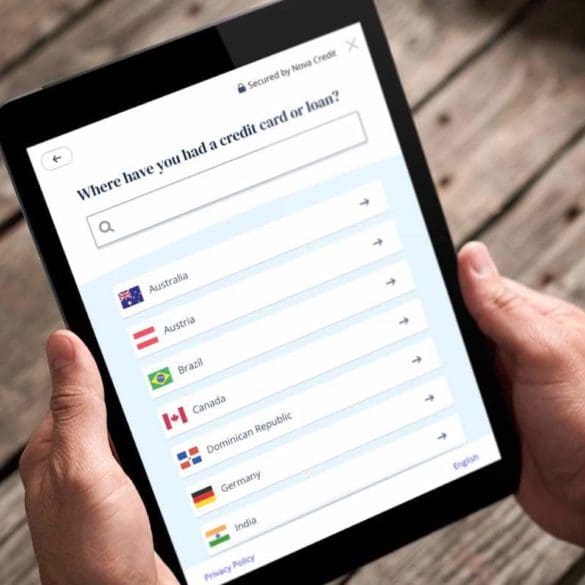

Nova has created products to assist migrants in gaining access to credit across borders. Their partnership with HSBC brings new capabilities.

Immigrants make up a vastly underserved demographic, Remitly's Matt Oppenheimer believes their potential financial impact is underated.

With a focus on money education, fintech companies have a renewed sense of purpose in creating greater financial inclusion for all.