Neu’s path to success will produce financially literate college graduates and a strong bottom line. The journey began in late 2023 with the release of the Neu Card, whose attributes include no late fees and interest charges, a maximum $1,000 spending limit, no Social Security number required, and no credit history or cosigner required.

While most banks have some type of financial education strategy, few customers realize it, results of a study by Greenlight reveal.

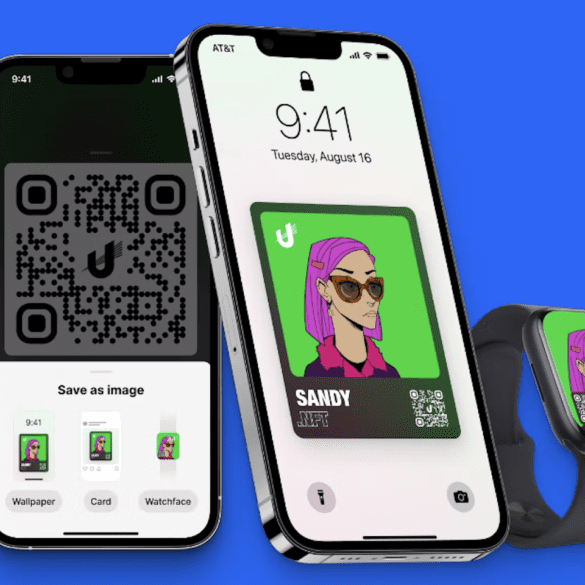

With accessibility long being a barrier for most mere mortals to enter Web3, Unstoppable Domains has launched an app to break it down.

GenZ is likely to approach finances differently than generations before, making basic financial literacy critical to avoid bad decisions.

Debit card and financial education app GoHenry, designed for kids aged 6-18, has a simple mission: make every kid smart with money.

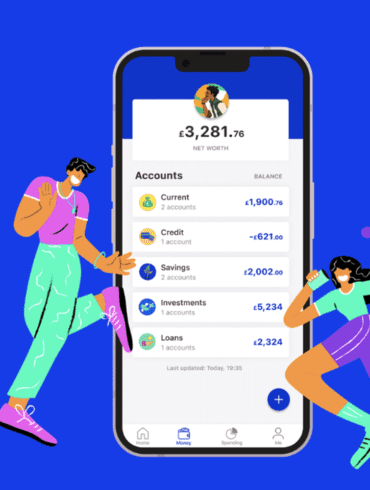

When designing an intelligent budget-tracking app, Piere founder and CEO Yuval Shmul Shuminer prioritized functionality, integrations, and meeting the evolving needs of emerging generations. Billed as the“intelligent budget tracker app that’s ready in just two taps,” Piere offers quick functionality and automatic reconciliations and updating.

In this episode we talk with Dee Choubey, the CEO and co-founder of MoneyLion. He shares how they are rethinking customer engagement, changing the form factor of finance, navigating the bear market in fintech valuations, going all-in on NASCAR and much more.

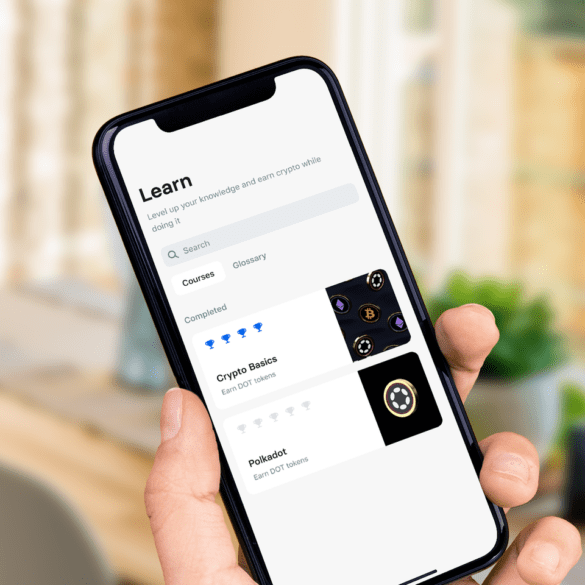

Crypto Basics covers how cryptocurrencies differ from fiat money, what a decentralized system is, how cryptography works, and the risks.

Gimi, in a partnership with ABN Amro has released a financial literacy app for children. According to its founder, the effects could go far beyond economic benefits.

A new survey by Israel-based Bank Leumi’s challenger brand Pepper found 90 percent of UK consumers feel they are undereducated...