Former Securities Exchange Commission Chairman Arthur Levitt, Sarah Friar, chief financial officer at Square, and Scott Sanborn, CEO of Lending Club recently spoke on a panel about regulation for fintech companies and recent improprieties; Sanborn noted that sound corporate governance is not unique to fintech, referencing the Wells Fargo story; panelists discussed that regulation is always behind innovation and how regulators and fintech companies may strike a balance. Source

JPMorgan Chase has been active in fintech partnerships with firms like Truecar, OnDeck and Roostify; they are now partnering with Bill.com in an effort to eliminate paper checks; JPMorgan spent $600 mn last year building fintech solutions and partnering with firms according to a letter CEO Jamie Dimon sent to shareholders in April. Source

Every year Inc. pulls together a list of the top 5000 fastest growing private companies in the United States. This...

A couple of weeks ago we published a podcast with the CEO of ZhongAn Insurance, Jeffrey Chen. I want to...

When I first started working for Lend Academy and LendIt I saw the massive opportunity for fintech companies to change...

Goldman Sachs first entered the market with the acquisition of GE Bank and the subsequent launch of GS bank; Tearsheet explores their other moves in the market more recently in fintech; Goldman Sachs has invested in 23 fintech startups and is the only top ten bank that has hit every category in its investments: blockchain, data analytics, insurance, personal finance, wealth management, financial services software, lending, payments and settlement, real estate and regulatory technology. Source

A writer in a Bloomberg opinion article believes that the next financial crisis will have its roots in Silicon Valley, not Wall Street; author cites that fintech companies are vulnerable to rapid, adverse shocks compared to Wall Street banks because fintech firms are small and undiversified; article also shares that fintech companies are more difficult to monitor and that the fintech industry has not developed the set of unwritten norms and expectations that guide traditional financial institutions. Source

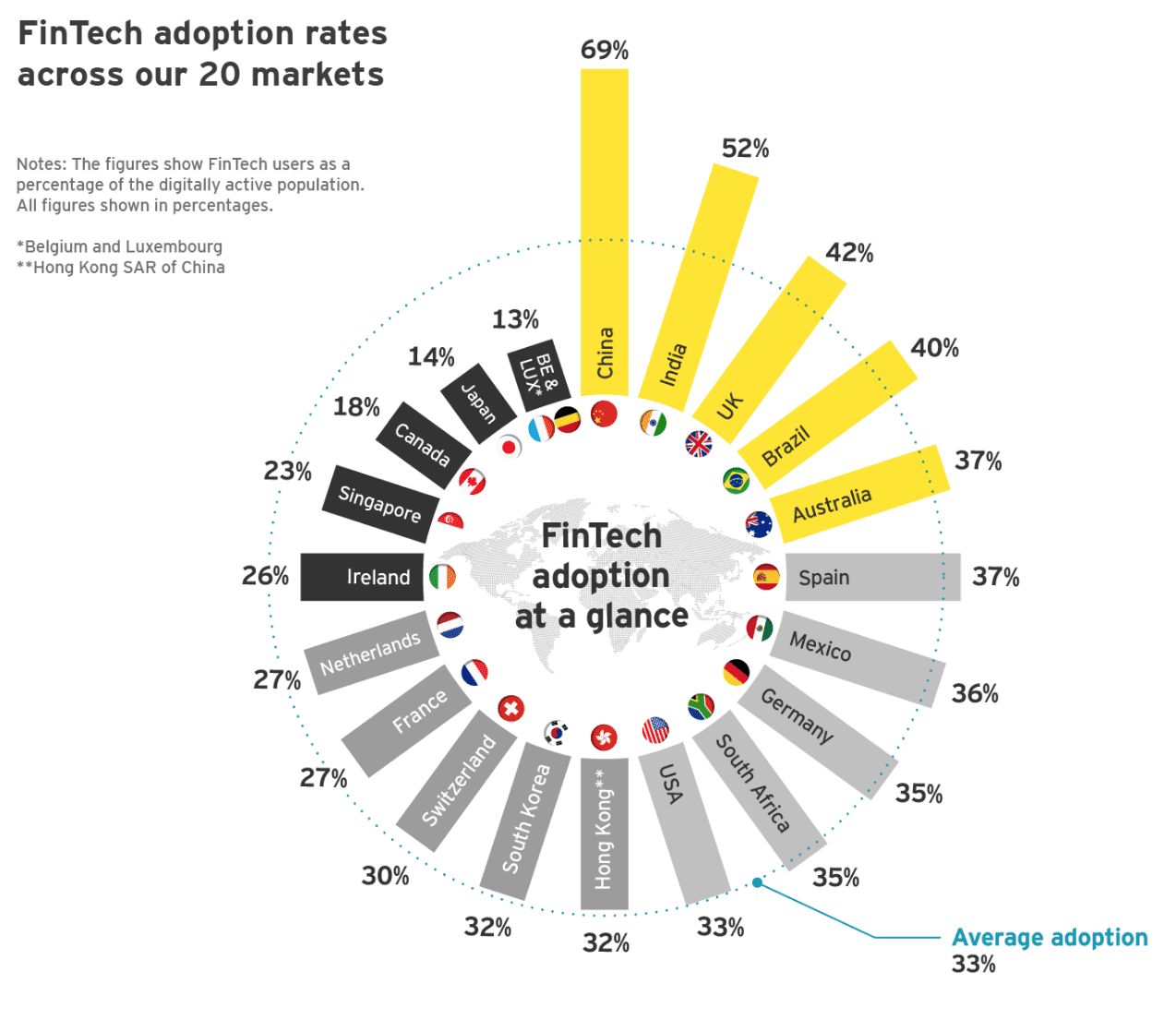

Back in April I attended a couple of roundtable discussions in New York organized by the World Economic Forum. Many...

[Editor’s note: This is a guest post from Gordon Suber, the father of Ron Suber, soon to be President Emeritus...

In Austin last week American Banker hosted their annual Digital Banking Conference where banks of all sizes gathered to discuss...