Parfin's seed round was led by Framework Ventures, one of Silicon Valley's leading managers in the crypto ecosystem.

Neon's fundraising comes at a time when the banking sector has seen default rates increase in Brazil.

Last year, 16 fintechs were authorized in Mexico. Among them, Albo, Belvo, Todito Pagos, Mercado Pago and Femsa's Spin by Oxxo.

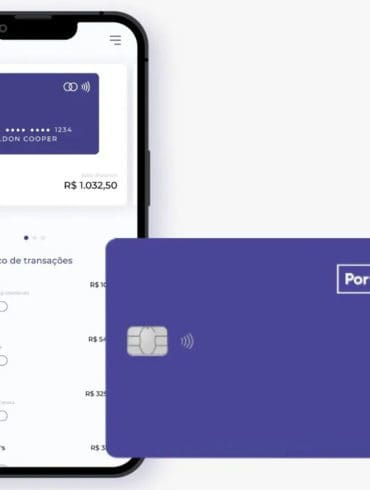

With the investment, Portão 3 plans to expand its team and its line of products and services, including corporate credit cards.

Destácame already has 4.5 million users and wants to reach 10 million users by 2025, expanding its operation in Mexico.

Nubank announced in October the creation of the digital currency, which is part of its new blockchain and crypto-assets initiative in LatAm.

iCred will use these resources to expand its operations and enter the payroll loan market for the beneficiaries of the social security fund.

Stripe's possible IPO sent excited waves through the industry. Many see it as the vote of confidence they have been waiting for.

Kredito was founded in 2018 to create a solution that would provide "fair interest rate" loans to startups and small-cap companies.

This new funding will allow Trii to expand operations in three key countries in the region: Colombia, Peru and Chile.