New Fiserv CEO Frank Bisignano is set to take over in July and has quite the to do list ahead...

Fiserv saw $3.7bn in revenue for Q4 2019 with First Data accounting for 61 percent of that total or $2.2bn;...

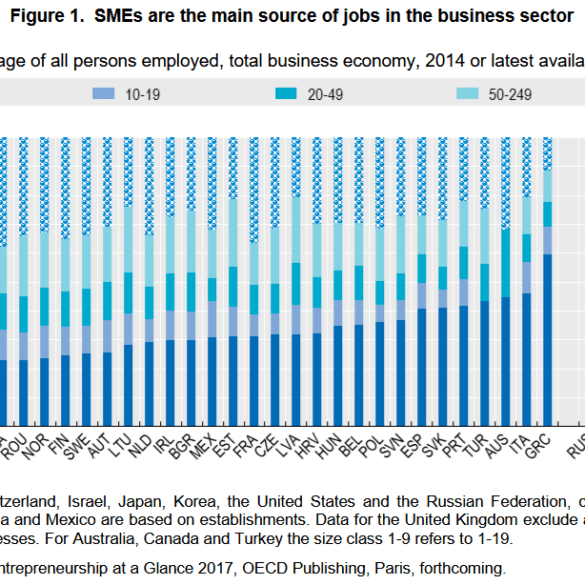

I have been reading Alibaba: The House that Jack Ma Built this week, something everyone interested in understanding the future of Google, Goldman, Uber, or Amazon should do. The narrative starts with China's small business explosion, and Ma's genius is to tap into global demand for the products of those businesses through an online marketplace and associated financial services. But I am getting ahead of myself. Let's pause to acknowledge a massive, systemic transaction that was announced this week: payments processing company Global Payments acquiring TSYS (Total Payments Systems) for $21.5 billion.

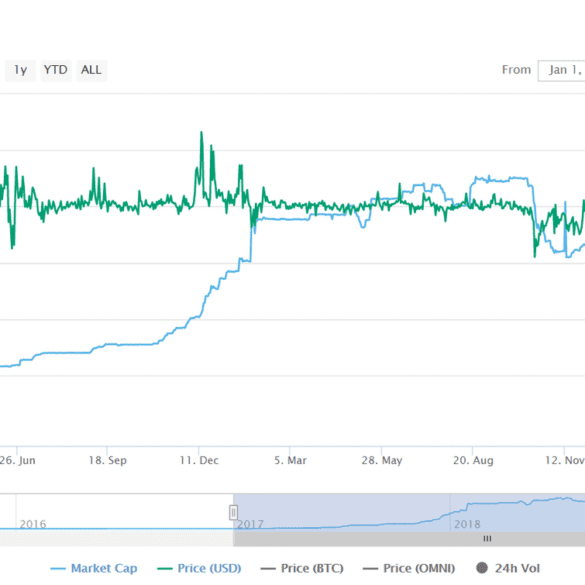

The Wall Street Journal is reporting that Facebook has been quietly working on a new cryptocurrency-based payments system. Dubbed Project...

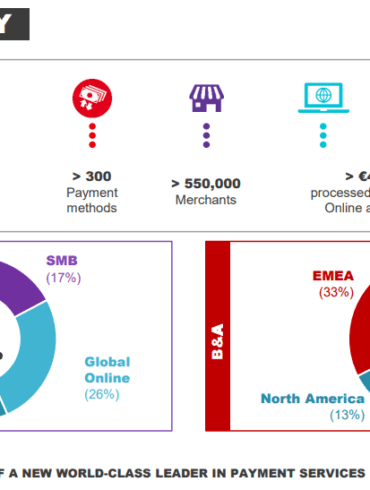

In an all-stock transaction of $22 billion, Fiserv has acquired First Data. The acquisition will allow Fiserv to now offer a...

I look at how spending $8 billion can either buy you $3 billion of revenue from Ingenico, or the private valuation of Robinhood and/or Revolut. Would you rather have a massive cash-flow machine, or a venture bet on a Millennial investing meme? To articulate this question in more detail, we walk through the impact behavioral finance has had on economic rational actor theories, and why quantitative financial modeling often similarly fails to capture the underlying tectonic plates of industry. It may not be wrong to bet on Millennials. We talk about what identity economics (ala identity politics) means for market value and how to think about generational change.

2019 has become a big year for fintech mergers and that trends look to continue for some time; payments in...

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

Fiserv‘s acquisition of First Data points to the power of fintech and the threat it poses to more traditional payments...

US regulators did not sign off on Ant Financial’s acquisition of MoneyGram, but this won’t hamper their US ambitions; Last May Ant Financial did a deal with First Data, the payment infrastructure company; Ant Financial has been largely successful in China due to the unique financial system there; in the US they face other challenges which includes a more developed financial system with legacy players; it remains to be seen whether the eventual leaders in the US will be technology companies like Amazon, something we’ve seen happen in China. Source