Fraud is a significant challenge for lenders, impacting both operational efficiency and financial stability. Legacy methods for detecting fraud are proving to be inadequate in the face of new techniques, so AI-powered detection is needed.

·

If a financial institution looks beyond the hype of AI and tempers its expectations, it can use AI to deliver measurable business results. That’s been the experience of Amount’s director of decision science Garrett Laird.

Fraud is rising with the increased reliance on alternative payment methods, and AI could stop it. FIs have difficulties in adopting the tech.

Real-time payments systems have globally increased the threat of related fraud. Will FedNow follow the trend?

Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed.

·

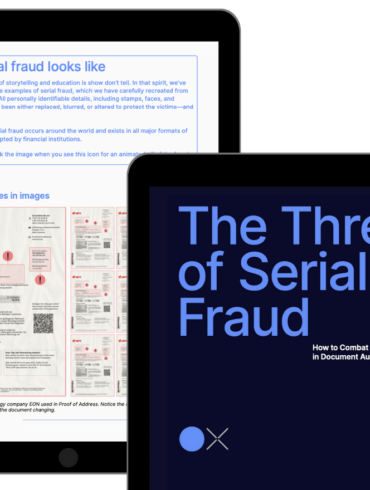

Serial fraud is becoming a major problem for financial institutions today as criminals use automation and scale like never before. This white paper provides actionable steps to combat serial fraud.

'The real power is that AI can actually predict or detect patterns of behavior and suspicious activity that would take a lot longer for traditional methods to uncover.'

While statistics vary year by year, there was a 79 percent increase in document fraud in 2022. Such a number doesn't come as a surprise to Inscribe fraud analyst Daragh McMeel. A rise in fraud rates often occurs when the economy travels an uncertain and difficult path.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

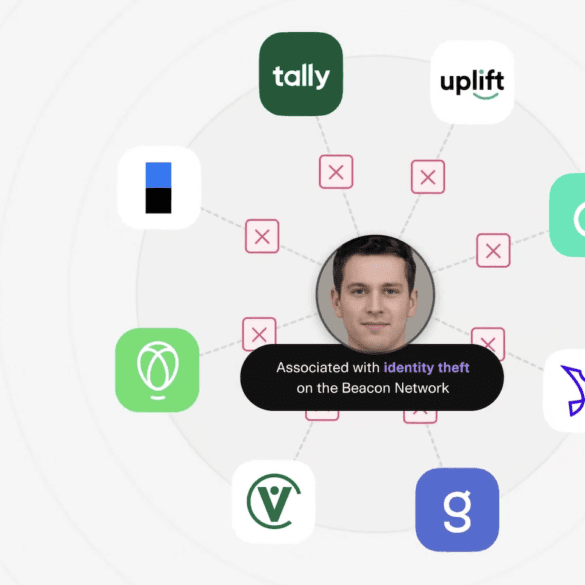

Sardine, a leader in the fraud prevention and compliance space has upped its game against widespread fraud.

Experian's fraud prevention data network, in existence since 1991, will be available for use in North America later this year.