Funding Circle was approved for a 7(a) license by the SBA but now there are some in Congress that want to take that away from them.

For too long small businesses have suffered a lack of access to capital. Now, banks and fintechs are in a unique position to combine their strength to help provide financing in underserved communities

On Tuesday, Denver-based online lender Funding Circle launched a partnership with DreamSpring, to increase access to funding for SMBs.

[Editor’s note: This is a guest post from Ryan Metcalf, Head of Public Policy & Social Impact at Funding Circle.] Fintech...

Here are the most read news stories from our daily newsletter today: The Clearing House On The Race for Real-Time...

Funding Circle has been approved by the SBA for one of three new licenses for its hallmark 7(a) small business lending program, the only fintech to be approved.

The SBA is making updates to its lending program opening the door for fintechs. But much more needs to be done.

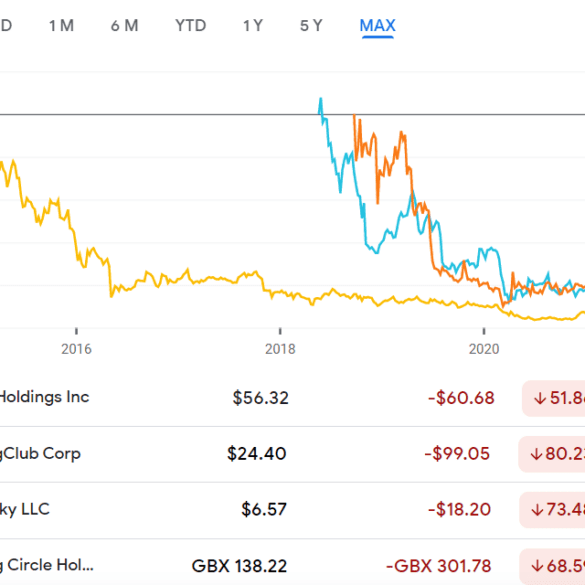

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

[Editor’s note: This is a guest post from Ryan Weeks, formerly with Dow Jones and AltFi, covering fintech. This is...

The British Business Bank (BBB) has approved The Bank of India and Silicon Valley Bank to deliver the Coronavirus Business...