Pinwheel’s Power of Primacy report shatters some myths about defining primacy while offering a better way forward.

Over $70 trillion in wealth transfer is in motion, underscoring the need for institutions to invest in serving the needs of younger consumers.

In this conversation, we delve deep into next generation finance and banking with CJ MacDonald, the Founder and CEO of Step – an incredibly successful neobank on a mission to improve the financial future of the next generation.

More specifically, we discuss traditional vs. digital banking, how personal experiences influence entrepreneurial the spirit, immersive market research, banking-as-a-service, the importance of financial literacy amongst Millenials and Gen-Z, the power of influencers who actually believe in a brand, aspirational brands vs. plastic Wells Fargo stage coaches, and lastly the proliferation of crypto in the minds of the next generation.

This week, we look at:

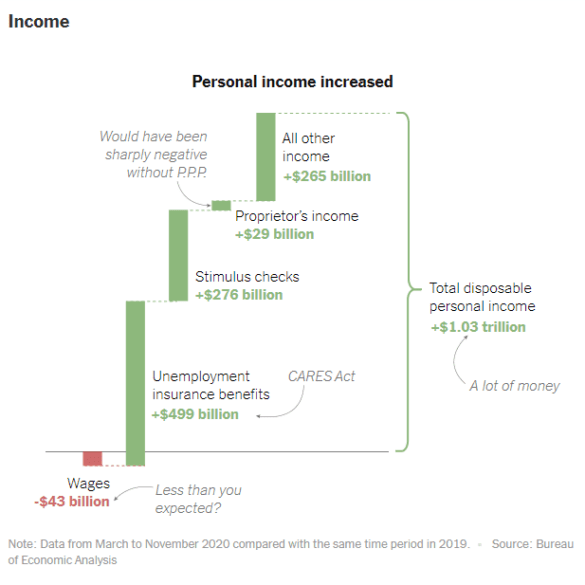

The spectacular price increase in crypto assets, hitting new records for Bitcoin, as well as the comparable statistical situation around Covid cases

An explanation of the $1.5 trilion income effect in 2020, and how it has led to both capital acumulation and inequity (thanks NY Times!)

A discussion of all-time-highs and all-time-lows, why we need them, and their connections to the macro-economy, computer code, music, and the universe itself

One wonderful takeaway from Watts, which of course is not his, but beautifully plagiarized into the English language, is the duality of experience. The need for polar opposites, in a clock-like cycle. To have black, you must have white. To have the top of the wave, you need the bottom of the wave. To have a melody, you need equally the presence of the notes, and their absence in silence. To breathe in, you need to breath out. It is meaningless to have a data point without the context in which it exists.

Results from MoneyLion's first Personal Financial Wellness Study confirm the growing influence of digital sources in our financial lives, but the steep drop-off of knowledge among millennials and Gen Z consumers.

As Gen Z grows into a robust consumer base, we need to consider factors influencing them and adjust strategies to attract and retain them.

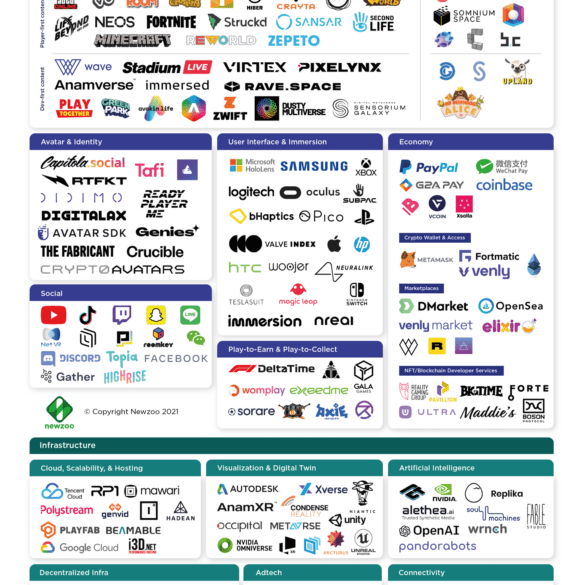

In this conversation, Cris Sheridan, who is the Senior Editor of Financial Sense and Host of FS Insider, leads the conversation around the basics to understand the exciting new digital universe, more commonly known as The Metaverse.

More specifically, we discuss all things VR & AR including social media’s proliferation into the sector, Millenial vs GenZ behavioural approaches to the metaverse, the creator economy, NFTs, Axie Infinity, Mr Beast, Computational Blockchains, Decentralized Autonomous Organizations (DAOs), ConsenSys, MetaMask, and Ethereum vs Institutional Finance (Schwab).

We’ve had this write-up in some various mental states floating around for a while, and better done than perfect. So treat this as a core idea to be fleshed out later.

Payments and banking companies should be looking at how people purchase and store digital goods and digital currency in video games. That experience has been polished over 40 years, and is what will be the default expectation for future generations.

For those interested, here is a website that collects user experiences of shopping across hundreds of designs.

There is a growing group of fintechs who have designed their products specifically for Gen Z, who are defined as...