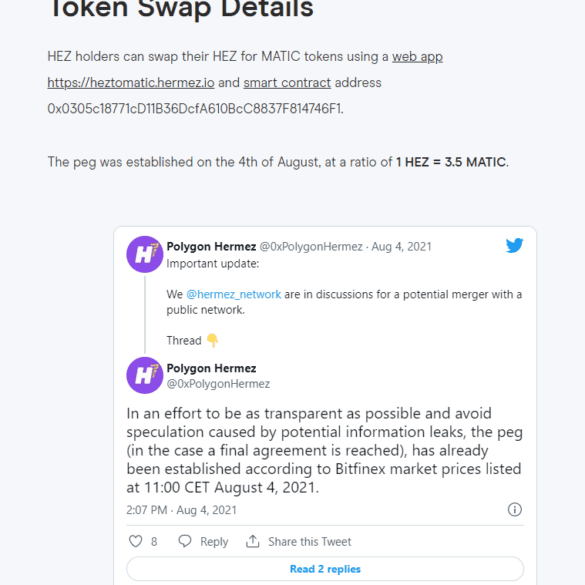

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

Ethereum prediction market firm Gnosis has completed an initial coin offering with the firm's creators owning 95% or approximately $280 million and investors buying 5% of the project's tokens for a total of $12 million; skeptics say the high market cap for the project is an example of recent irrationality in token sales; however, as more initial coin offerings are successful, investors appear to be growing more comfortable with the investments. Source