Gold Token investment is on the rise, 2022 has already seen a 4% increase compared to Bitcoin's 18% decrease. The asset is seen as low risk, resisting inflation, but is this really the case?

This week, we cover these ideas:

Crypto prices show increasing correlation in market swings, which hides the large substantive differences between projects

The core narrative of Bitcoin, and its fundamental indicators

The core narrative of Ethereum and Web3, and its fundamental indicators

A sanity check on potential market caps relative to gold, equities, and other assets

The new feature is open to Premium and Metal customers at a time when the price of gold has recently...

Glint is based in London and today revealed their product offering; it is a multi-currency account, app and card that lets users store money in gold; funds are converted back to fiat currency at the point of payment for those who choose to store their money in gold; the company is regulated by the FCA. Source

Meet Glint, a British fintech with an app and debit card that enables users to save, exchange, and spend in physical gold and multiple currencies.

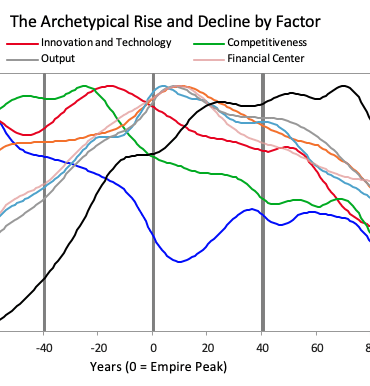

This week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

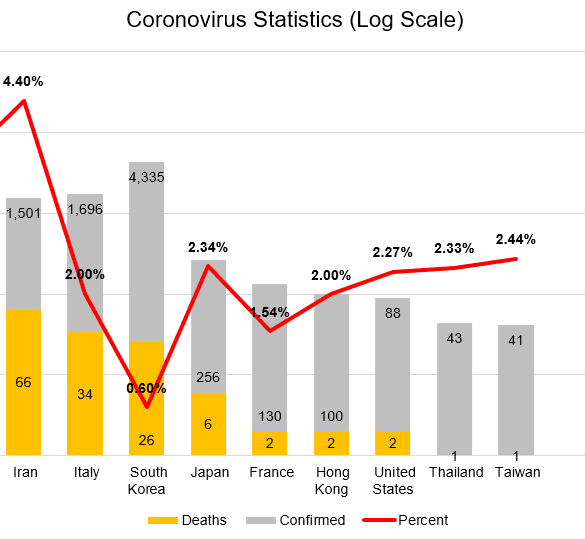

I look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low -- but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that's what the conspiracy theorists want you to think!