Dodd-Frank requires banks to disclose information about employee wages and the data shows a mixed bag for banks; banks like Goldman Sachs lie on the high end of the pay scale while small banks in locations like Houston are at the bottom of the spectrum; what the data also shows is banks are finding it hard to compete with big tech firms for talent as companies like Google, Facebook and Amazon tend to pay premium wages; wages overall look to be rising as lower skill, lower wage jobs are becoming less frequent across the industry. Source.

The online lender has named Bank of America Merrill Lynch, Goldman Sachs, Morgan Stanley and Numis Corp to work on their upcoming IPO; the IPO is currently slated for the second or third quarter which may value the company around $2 billion; if successful it would be the largest IPO for a British fintech company; Index Ventures, Union Square Ventures and Accel Partners were early investors in the company. Source

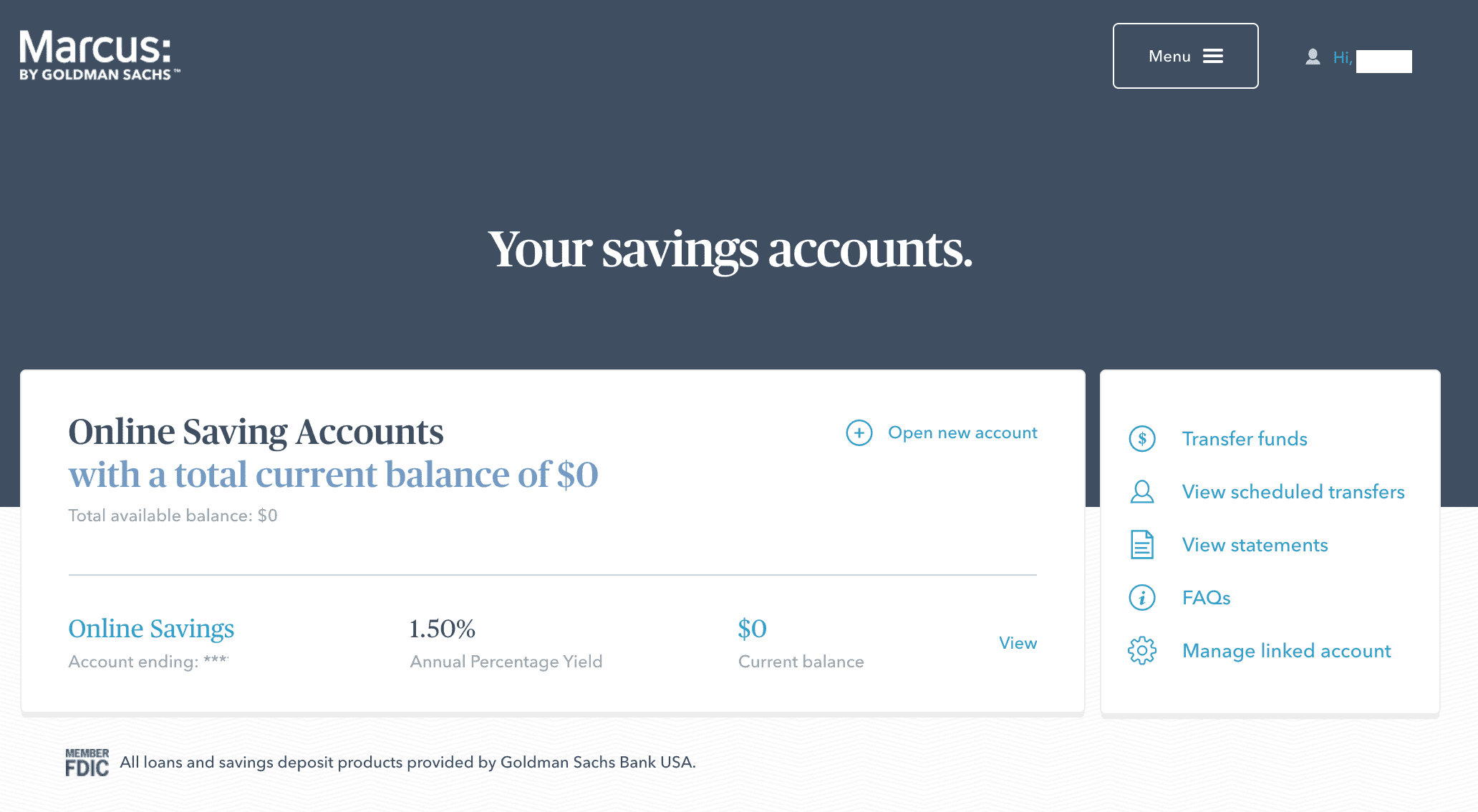

The WSJ reviews Goldman’s push into consumer finance; the company first started offering loans under the Marcus brand which is the new branding for their savings account; Goldman has higher aspirations though with more initiatives in point of sale, wealth management, budgeting tools, insurance, mortgages and car loans; the company is also working with Fortune 500 companies to offer bank accounts as an employee perk; beyond their internal efforts they have also been active in acquiring fintech companies. Source

For many years there have been few opportunities for yield which is one of the reasons some investors turned to...

Goldman Sachs is currently in discussions to buy personal financial management app Clarity Money according to reporting by American Banker; they plan to roll the company in their Marcus brand; this is the latest move by the wall street titan to build out their consumer focus; Clarity Money uses AI to help consumers make better financial decisions by lowering bills, finding better credit cards and creating a savings account. Source.

Goldman Sachs has launched an in house incubator that will allow employees to work on innovative ideas; GS Accelerate is currently accepting applications to move Goldman into new business areas, manage risk and try to fix inefficiencies; the move is part of a wider strategy for Goldman who now shows 46 percent of staff being in technology; “When it comes to entrepreneurship, there are always more failures than successes,” a memo reported by TearSheet stated. “But if we’re creative, imaginative and learn from what did and didn’t work, GS Accelerate can become a powerful engine to bring important ideas to life.” Source.

The bank is currently recruiting engineers to help launch the online lending platform Marcus in the UK according to Business Insider who found the job listings; last September Goldman Sachs said the Marcus brand would launch in mid 2018; Goldman Sachs’ Marcus has taken off in the US and have been aggressive in expanding their consumer finance offerings. Source

As rates rise fixed income investors are looking for places to put cash; Lend Academy shares the latest rates on savings and CD accounts as well as a look at the newly branded Marcus by Goldman Sachs bank account. Source

Lloyd Blankfein recently presented at the Credit Suisse 19th Annual Financial Services Forum; Blankfein shared that Marcus has access to over $17 billion in deposits; since the acquisition of GE Capital, retail deposits have grown 90% which gives allows them to access cheap capital; Goldman plans to grow consumer products offered through Marcus. Source

According to the WSJ, Goldman Sachs is in talks to offer financing on Apple products; this would be alternative to a consumer financing devices on a credit card; both companies didn’t comment on the story, but if a deal came together it could propel Goldman’s Marcus further into consumer finance. Source