Last week Goldman Sachs launched a new product called GS Select. Before we get into the new product I think...

Goldman Sachs reported its first quarter earnings on April 18 with few details about its new online lending platform, Marcus; the only mention of the new platform was in the analyst Q&A; the firm said the new platform is evolving slowly and is operating according to plans; the firm reported revenue of $8.03 billion, an increase of 26.7% from the first quarter of 2016; net earnings were $2.26 billion and earnings per share were $5.15; disappointing trading revenue was a point of emphasis for the quarter; investors are interested in more details about Marcus, which has a competitive cost advantage and is reporting potential return on assets of three times the return on assets of the firm as a whole at 3%; as Goldman Sachs progresses further with its retail business expansion, investors will be watching the retail business contribution overall which could help to cover some of its recent shortcomings and give it an edge over its competitors. Source

Eric Schmidt, chairman of Google's parent company, Alphabet has become CFO Marty Chavez's new mentor at Goldman Sachs; the relationship is part of a new initiative that has Goldman Sachs focused on making its services for risk comparable to Google's services for search; the bank wants to be the leading source for trading and managing risks giving its firm the attention of risk managers that Google gets from advertisers; to do this it has created Data Lake, a machine learning platform that manages information on transactions, markets and investment research as well as communication from emails, voice calls and instant messages; the new internal technology system is based on APIs that connect different parts of the business to the Data Lake central database making its communication processes more efficient. Source

Goldman Sachs appears to be planning for a robo advisory service offering; the firm is advertising a job posting for a GSAM Technology digital experience developer that would build an automated robo advisory platform complementing the firm's asset management business; the bank's private wealth management business focuses on client's with approximately $50 million in investable assets; it has been broadening its client demographic recently by including business and retail products for investors with $1 million or less; a robo advisory service would add to other recent product expansions including the acquisition of GE Capital's online bank, Marcus and Honest Dollar. Source

Goldman Sachs's Marty Chavez has helped lead the bank to new levels of automation which have been revolutionizing the financial services industry; Chavez provides details on how the bank's equity trading desk was consolidated from 600 employees to two traders; automation has also evolved significantly for currency trading and investment banking; Chavez sees the trend continuing with more computer engineers replacing traders and investment banking tasks involved with transactions such as initial public offerings also becoming automated. Source

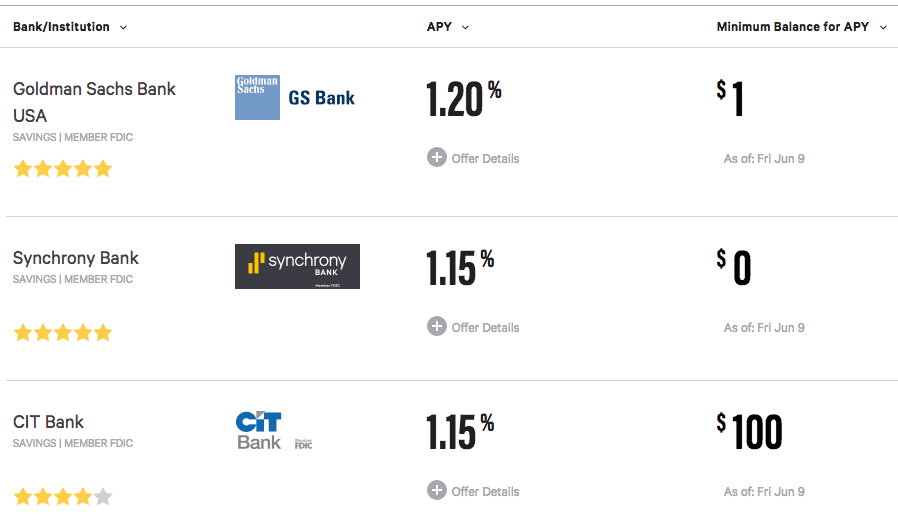

I noticed this report in Forbes last week which discussed a recent increase that Goldman Sachs was making on their...

Goldman Sachs is estimating a 500% return on its initial investment of $550 million in credit data provider TransUnion; the investment began in 2012 when Goldman Sachs bought TransUnion; since then TransUnion has gone public with shares opening at $22.50 on June 25, 2015 and currently trading at $38.23; Goldman Sachs has also earned $50 million from TransUnion's IPO and debt underwriting; additionally, Goldman Sachs is reporting a number of other advantages from the investment including support for its newly launched consumer lending platform Marcus which is a client of TransUnion. Source

Marketplace provides insight on Goldman Sachs' new online lending business discussing the culture and variance from the traditional aspects of the investment bank; one reason for the divergence in culture is the company's focus on building Marcus as a tech startup within the bank; the investment bank's venture has gained considerable industry attention and also attracted talent from leading technology companies including Facebook and Google; it appears to be well positioned in the market with numerous competitive advantages supported by the legacy bank's 147 year history. Source

Harit Talwar discussed the new Goldman Sachs online lending platform, Marcus, and six ways the company is striving for a competitive edge in the market at LendIt USA; one of the platform's top marketing initiatives is direct mail marketing which Talwar say consumers are highly responsive to; the firm is also not charging any fees, allowing for one deferred payment and staffing its call center with human agents. Source

Goldman considers Marcus a fintech startup supported by 147 years of experience from the global investment bank which has given it some advantages in the online lending market; the fintech startup and its use of application programming interfaces (APIs) has been part of some important digital innovation initiatives for the firm; according to Chavez, Goldman is not only exploiting APIs, but open source and cloud services as well; he refers to the integration of the three services as the most "profound drivers" of innovation in financial services he's ever experienced; Goldman has integrated APIs into nearly all aspects of its business and API-centric technology is a key factor for innovation in the global fintech market. Source