Embedded finance can help small businesses manage their money end-to-end, but not all companies are equipped to offer it properly.

This week saw three fintech firms representing payments, debit, and credit post results. Although each saw momentous growth year over year, in some cases, it was not enough to outpace expectations after this bull run of a year for fintech.

The fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

Welcome Technologies has launched a new digital bank account in partnership with Green Dot; called PODERcard it is targeted at...

Green Dot’s Founders & CEO Steve Streit left the company in December 2019 as they were transitioning from prepaid card...

Lots of crypto news this past week with a big round from ConsenSys, a big vote in the EU and everyone wonders what Apple will do with crypto.

This week, we look at:

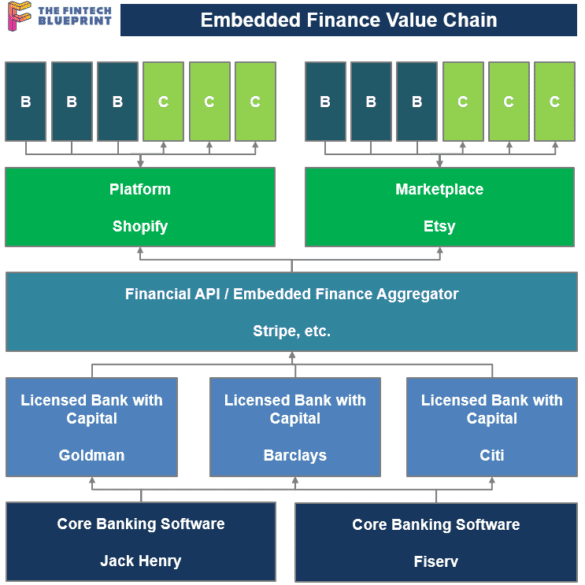

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

Today, Kabbage announced the launch of their new small business checking account called Kabbage Checking; it is being offered in...

Walmart and Green Dot first partnered in 2006 with the Walmart Moneycard, this January they extended that partnership another seven...

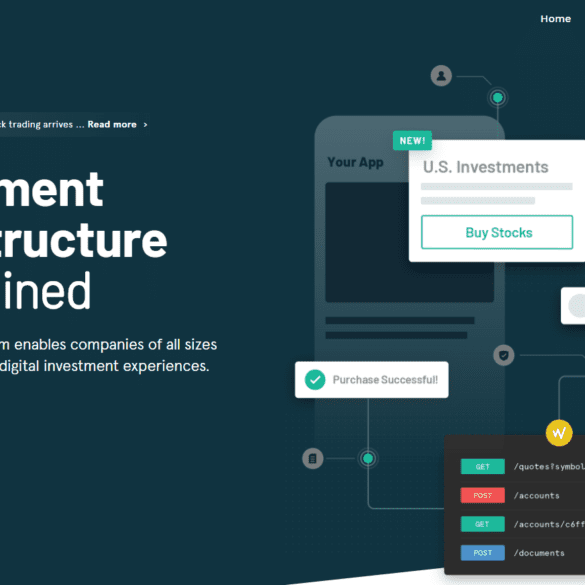

I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?