Mike Cagney is one of the most successful fintech entrepreneurs with his founding of SoFi and now Figure; Cagney sat...

Blockchain based lending fintech Figure has seen a 300 percent surge in loan applications due to the recent rate cut...

It was last November when we first heard that Prosper had plans to expand their offerings from personal...

Cagney was previously the CEO of SoFi; his new venture focuses on home equity loans using blockchain to make the...

Goldman Sachs continues to expand into consumer lending and plans to offer home improvement loans this month; the loans are non-secured personal loans with interest rates lower than credit cards but higher than HELOCs; the company believes the quick financing time will be attractive compared to a HELOC. Source

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

Figure, the blockchain-based fintech lending startup founded by Mike Cagney, has a new president; Asiff Hirji was the former president...

Back in 2005, Prosper was the first peer to peer lender to launch in this country, offering online unsecured consumer...

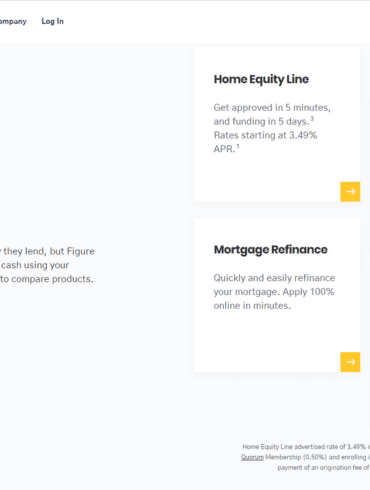

Mike Cagney was previously a co-founder of SoFi; after resigning last year he began work on a new startup which involves home improvement financing and HELOCs; the company is called Figure and is live at www.figure.com; according to the website, “Figure is a financial technology company with the mission of leveraging blockchain, AI and advanced analytics to unlock new access points for consumer credit products that can transform the financial lives of our customers. We provide home equity release solutions, including home equity lines of credit, home improvement loans and home buy-lease back offerings for retirement.” Source

Lend Academy discusses the changes to the home equity line of credit tax interest deduction with the new tax law and how it may affect unsecured lenders. Source