In this episode we talk with Jacob Haar, founder of CIM, on why there is still so much opportunity for debt investing in underserved markets

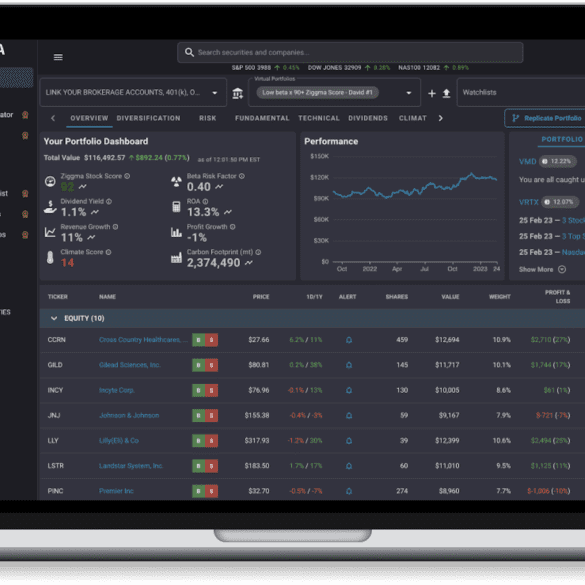

For investors who want to make an impact on the climate crisis, Ziggma provides data on companies' financial performance and their footprint.

Avoiding the ESG hype, Clim8 has created a unique investment portfolio, helping to empower customers to make a positive impact on climate change.

Catherine Berman founded CNote along with Yuliya Tarasava in 2016 to create financial products that decrease inequality rather than perpetuate...

There are many areas of finance that are really stepping up during the crisis. We have talked at length about...

The investment app provides users with in-depth data insights on company practices and voting announcements.

In our fifth episode, Isabelle Castro talks to the co-founders of FLIT invest about the effect fintech has had on impact investing.

Impact investing is having a moment. While it has been around in some form for several decades, today, many large...

The Co-Founder and Managing Partner of Community Investment Management talks impact investing and the role it can play during the...

Grameen America wants banks and social impact investors to help fuel a doubling of their loan portfolio in the next 5 years; most of the new money to lend will come from their inaugural Small Business Fund and the remaining amount is where they will turn to banks and social impact investors; “It's a way to appeal to impact investors who are interested in this kind of concept as opposed to pure philanthropy,” says David Gough, CFO, to American Banker when talking about the company’s shift to impact investors to fuel growth. Source.