The Bank of England decided to keep rates steady at 0.5 percent which will be a big benefit to P2P...

For many years there have been few opportunities for yield which is one of the reasons some investors turned to...

Customers are becoming more demanding as interest rates climb; the average interest rate paid by the biggest US Banks jumped to 0.40% in the third quarter; sophisticated customers are now reconsidering where they hold their cash accounts; Fifth Third is one bank that is raising rates for these types of customers; wealth management deposits have decreased at Bank of America, JP Morgan and Wells Fargo in the third quarter according to Autonomous Research. Source

The Federal Open Market Committee (FOMC) ended its two-day policy meeting on Wednesday and released an afternoon announcement reporting no change to the central bank borrowing rate which will remain at 0.25% to 0.50%; as expected the FOMC's statement did indicate that a rate hike in December was likely with new language saying the 2% inflation objective is near and that the Fed only needs "some further evidence" of economic progress for a rate increase; globally the US is one of few central banks tightening monetary policy; many are easing with negative rates; Japan's central bank borrowing rate is -0.10% and the ECB central bank borrowing rate is at 0% for the Eurozone; the Bank of England will be meeting on Thursday and is expected to keep its rate unchanged with further easing in 2017. Source

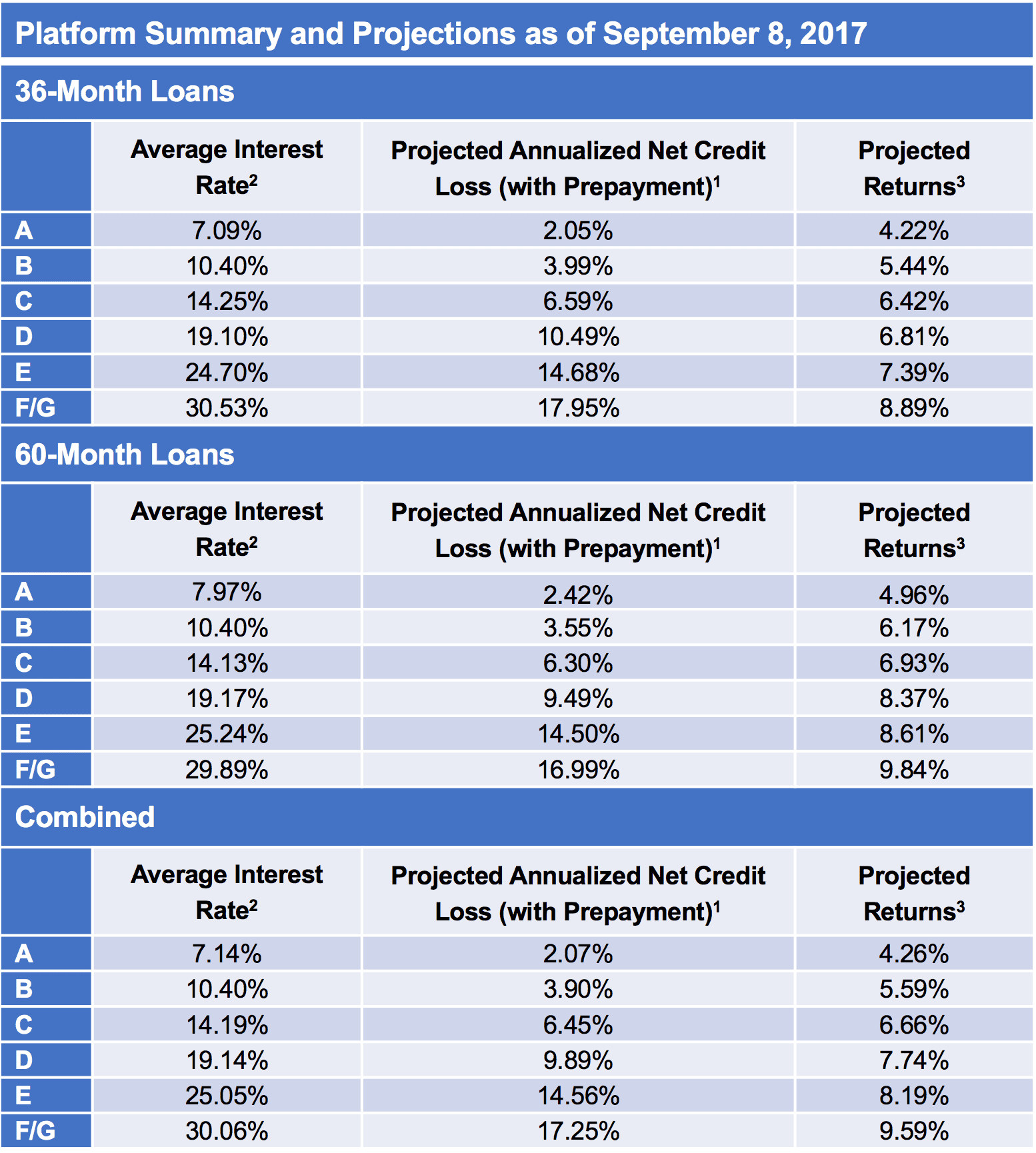

There has been a lot of news recently with regards to interest rates and loan performance on the Lending Club...

Bank lending is once again off to a slow start in 2018, but signs show the slowdown will only be temporary; the recent tax cuts could help to spur more borrowing; interest rate rises on the other hand could hurt companies looking to potentially borrow; as the economy keeps trending positively banks should see lending pick up in the coming months. Source.

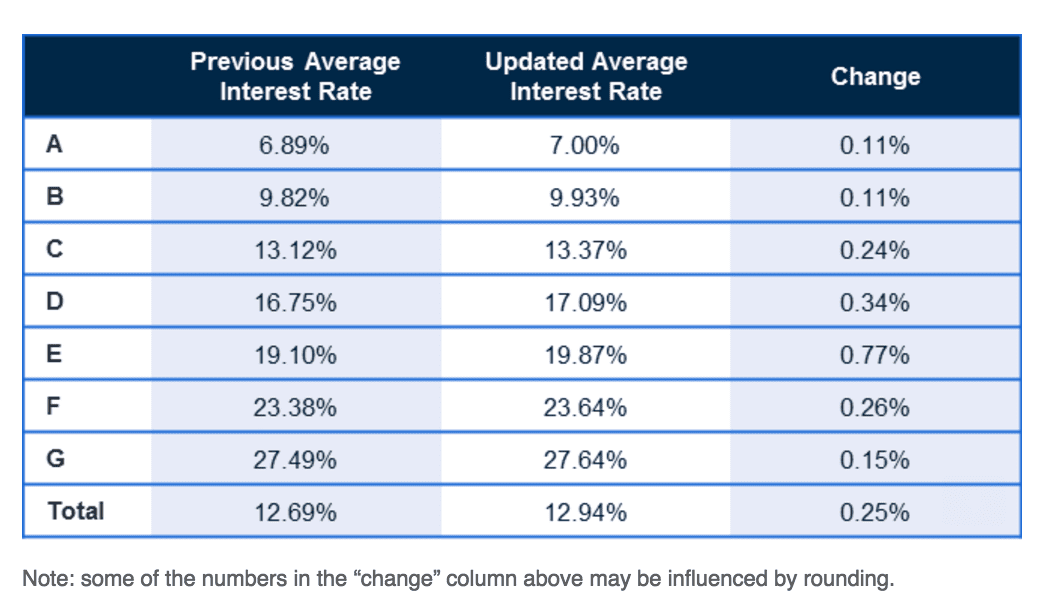

Lend Academy looks at the shift of returns and interest rates at LendingClub; the company recently brought F & G loans in house and there is a noticeable shift in loan grades offered by the platform. Source

Today, Lending Club announced a new credit model in an email to investors. According to the email, this is the...

The Bank of England kept its central bank borrowing rate at 0.25% and decided to continue with its $86 billion asset purchase program; while no changes were made to monetary policy, the BOE changed its guidance; with an increased focus on inflation in the region, the BOE said it would be prepared to raise rates in order to keep inflation at its 2% target rate. Source

How rising interest rates would affect marketplace lenders has been a question that many people have been asking for a long...