Amdist valuation troubles and a looming tax bill, Stripe raises $6.5 billion in Series I funding round, beating skepticism.

Given LendingClub is a platform serving borrowers and investors there is a lot of transparency on what changes they are...

In an op-ed on CNBC.com the president and CEO of the Florida Bankers Association writes about the importance of community...

Groundfloor is a company that has been around since 2013, which is a long time when you consider just how...

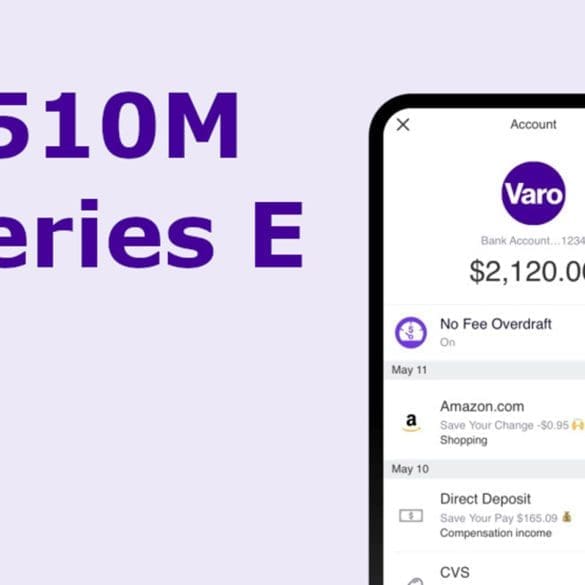

The company has tripled its revenue and added new products like the Varo Advance personal credit advance announced in October last year.

The product lets users get small amounts of credit, starting from a feeless $20.

By now you’ve probably received many emails from financial institutions related to what they are doing for those impacted by...

Crunchbase shares the top seed, early and late-stage investors by total number investments since January 2017; topping the list in seed stage investments was Y Combinator with 28 total fintech investments followed by Plug and Play and 500 Startups; Plug and Play topped the list in the early-stage category; Bain Capital Ventures led in late stage investments with 6 followed by General Catalyst, Khosla Ventures, Menlo Ventures, Spark Capital and Union Square Ventures who all completed 5 deals in the time frame. Source

There have been many recent launches of digital banks which was a result of regulatory changes in the UK; Metro Bank was the first having launched in 2010, but there are many new names since then; article highlights founders and investors in the space including Eileen Burbidge (Monzo), Sanjeev Gupta (Wyelands Bank), Jonathan Rowland (Redwood Bank), Nick Ogden (ClearBank) and the Pears family (Masthaven Bank). Source