Pinwheel’s new partnership with Jack Henry will help banks and credit unions win primacy with more clients.

This week, we look at:

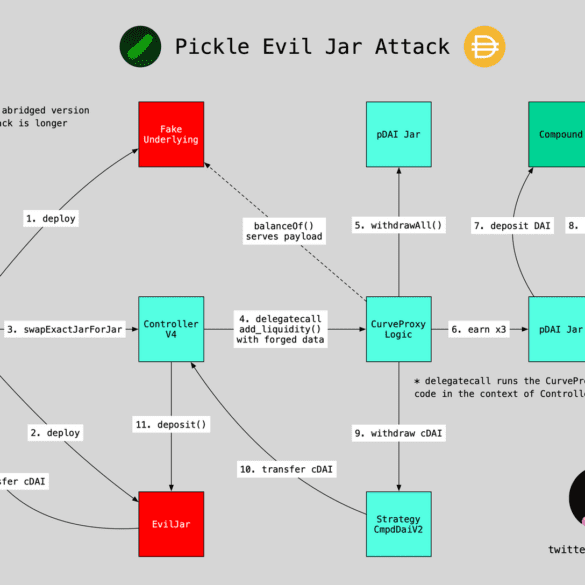

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

Today, we talk through a few recent events that are indicative of what’s important in fintech right now.

Varo raised $241 million in preparation to start operating under its own banking license later this year. Is a banking license an asset or a liability if you’re a digital bank?

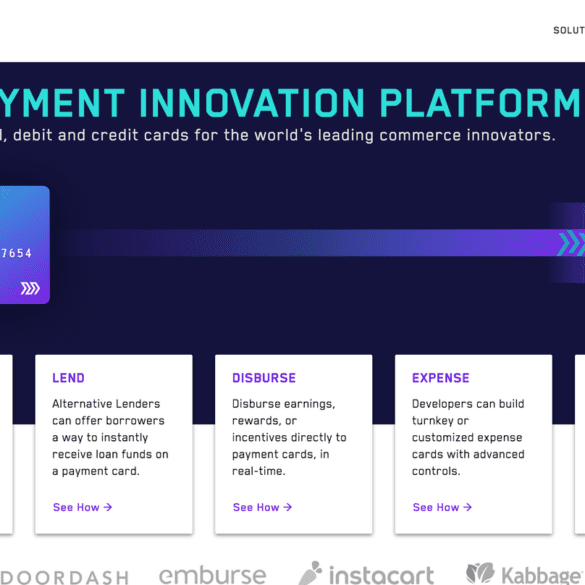

Marqeta is reportedly now valued at $4.3 billion, as banking-as-a-service continues its mature.

And LA-based fintech Stackin’ raised $13 million to scale its messaging-based offering designed to help Gen Z find the right fintech. What should we make of this?

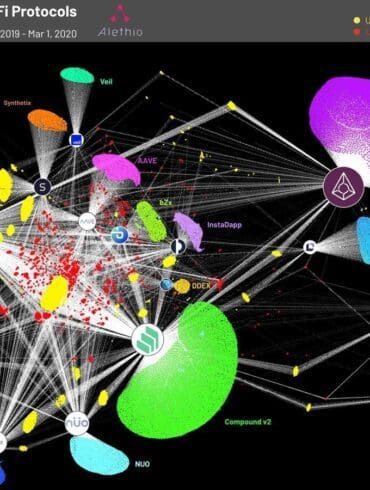

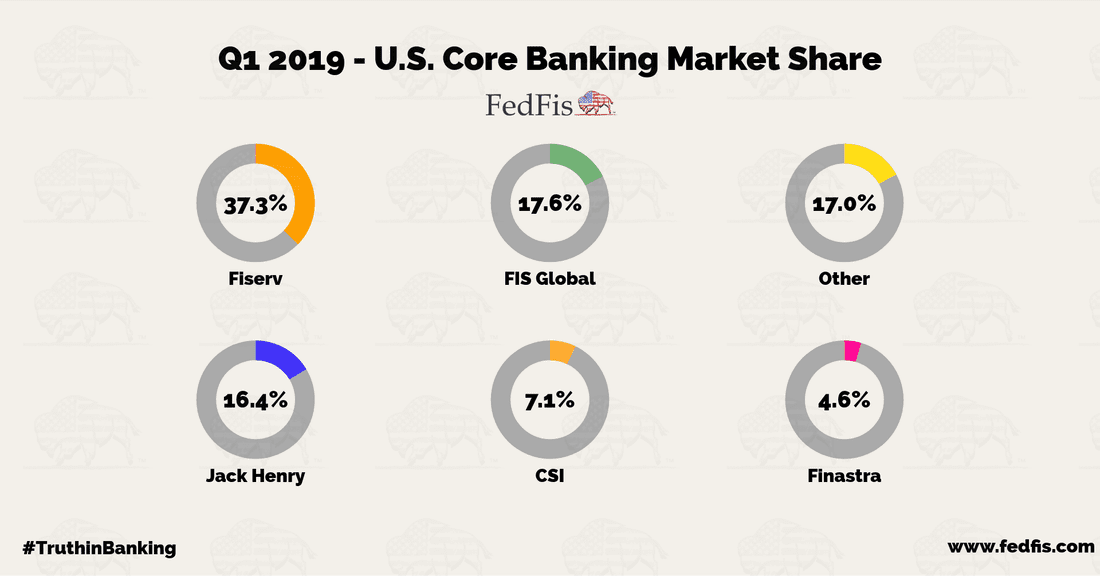

I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...

The road towards increased renewable energy usage is a rocky one that needs to be financed.

Before Covid it was a matter of vendor philosophy when it came to doing a core conversion in-person or remotely;...

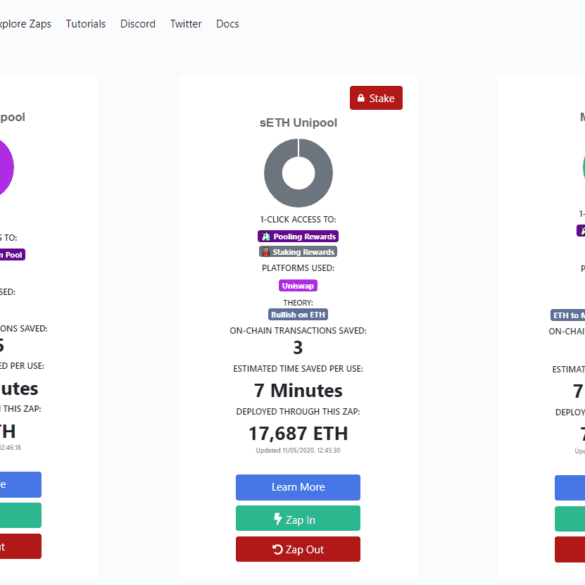

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

The core banking provider market is starting to feel the winds of change as banks start seeking newer providers and...

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...