It has been an interesting to say the least as we have watched everything play out with the Paycheck Protection...

Kabbage is now accepting applications from small businesses under the Paycheck Protection Program (PPP); Kabbage recently stopped lending on March...

Now more than ever it is important to bring the fintech community together. Many readers are already aware that we...

Kabbage has been working on new ways that they can serve small businesses; they recently announced the launch of extremely...

Kabbage’s latest product offering is available for Kabbage Payments customers; loans are available for as short as 3 days and...

The online lending industry has been ready, willing and able to help American small businesses with the Paycheck Protection Program...

Online small business lender Kabbage as furloughed a significant number of the 500 employees in the U.S.; the company hopes...

Kabbage launched a new website called www.helpsmallbusiness.com; the website allows consumers to purchase online gift cards from small businesses; revenue...

Kabbage continues to look into how they can serve small businesses in new ways. We recently shared Kabbage’s announcement of...

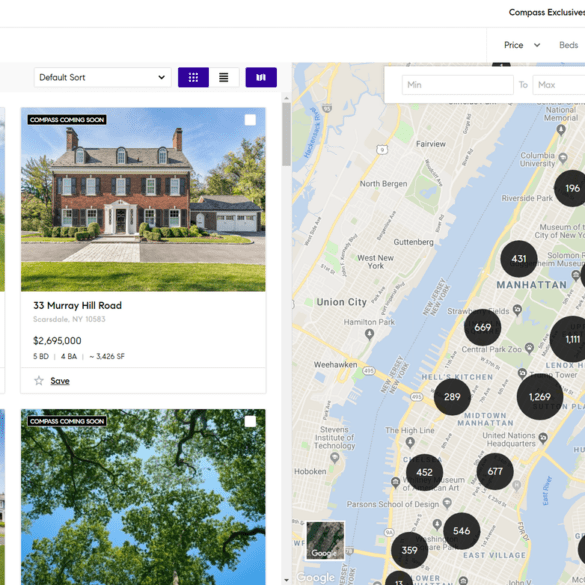

I examine how $6.4 billion real estate brokerage Compass stacks up against the digital wealth and lending companies with a similar go-to-market strategy, and provide some ideas as to why it is successful. Compelling questions also emerge when looking on how technologies like AR/VR are commoditizing the property brokerage experience. Compass, a residential real estate startup that built out a platform for brokers -- proprietary and external -- and has recently raised $370 million at a $6.4 billion valuation. I found the language and positioning sort of eery, in how similar it was to the story in industries I closely follow. It even bought a CRM earlier this year, not unlike AdvisorEngine buying Junxure, or Salesforce getting into financial verticals. What I did find unusual, was the absolutely massive valuation.