Small business lender Kabbage has announced a new milestone with total lending originations of over $3 billion; firm has provided loans for over 100,000 small businesses; helping to reach the new high, the firm provided 20,000 loans in March and reports $1 billion in funding serviced in less than a year. Source

Bloomberg provides insight on factors involved in a potential takeover of OnDeck Capital after rumors on Thursday that Kabbage was considering an offer to acquire the firm; it seems OnDeck's shareholders would likely veto a takeover with 45% of the company still owned by its original investors; as a private company, the structuring of the deal terms for Kabbage would also be difficult and to gain any interest from OnDeck's shareholders they would have to offer a considerable premium. Source

Kabbage has reported it will open a new office in Ireland; the geographic expansion follows a 50 million euro ($54 million) investment from the Irish Strategic Investment Fund which is managed by the country's National Treasury Management Agency; the Kabbage lending platform is focused on lending to small businesses and the firm expects to help support the Irish small business sector while also creating many high-quality financial services jobs in Ireland. Source

As non bank lenders continue to gain market share across different loan segments, we wanted to give a complete overview...

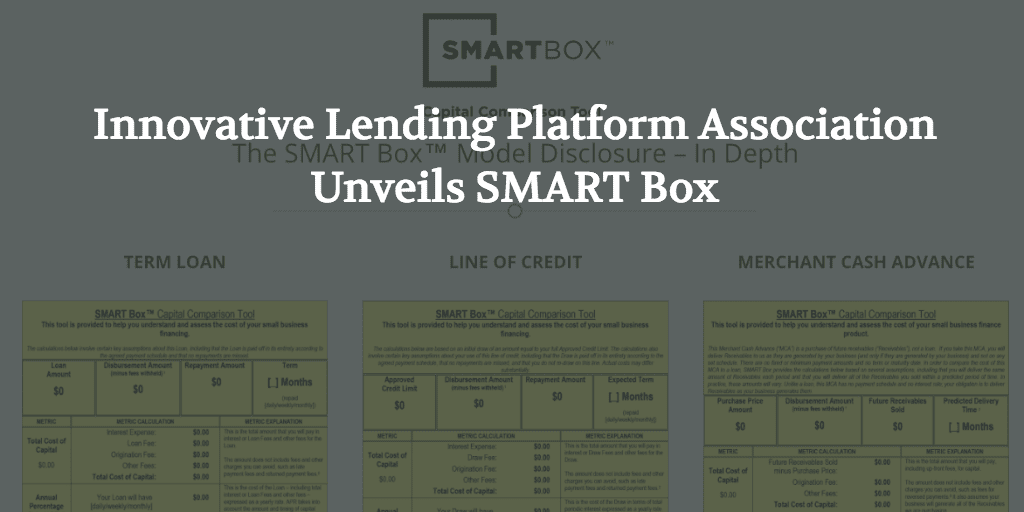

The Innovative Lending Platform Association (ILPA) has released SMART Box for small business lending disclosure and transparency; Lend Academy provides more details and insight from Kathryn Petralia of Kabbage in their article; the SMART Box is intended to provide standardized pricing, cost of capital and verbiage that borrowers can use for credit analysis and comparison. Source

Kabbage is reportedly considering an acquisition of small business online lender OnDeck; S&P Global analyzes a potential merger between the two firms which has high value deal prospects including combined 2016 SME loan originations of $3.82 billion, costs savings from similar balance sheet and securitization funding sources, and similar success in technology licensing partnerships, overall resulting in increased margins, earnings and more competitive terms to borrowers; the valuation metrics and negotiation factors are the main constraints to a potential deal; the minimum enterprise value reported by S&P Global is $291.7 million which is below its current market cap of $372.4 million and far below its original IPO valuation of $1.3 billion; key factors to watch for 2017 will be OnDeck's forecasted EBITDA and fundraising obtained by Kabbage. Source

Small business lender Kabbage is planning for a new equity fundraising, targeting a few hundred million dollars; sources say the lender is considering potential acquisitions including a buyout of OnDeck; Kabbage has reported a number of recent successes including a partnership with Banco Santander, expansion to Ireland and the industry's largest asset-backed securitization of small business loans. Source

Kabbage has announced the pricing of its first securitization of the year; the portfolio was valued at $525 million and includes small business loans; it is structured in four classes and has received ratings from Kroll Bond Rating Agency with the majority of the portfolio rated A; the deal is expected to close around March 20. Source

Small business, marketplace lender, Kabbage, has announced two new executive hires; the executive hires will focus on technology and data as the company seeks to expand and gain greater market share in online small business lending; Amala Duggirala will join Kabbage as the chief technology officer and Rama Rao will be the chief data officer. Source

Yesterday, the Innovative Lending Platform Association (ILPA), made up of small business online lending leaders OnDeck, Kabbage and CAN Capital,...

No More Content