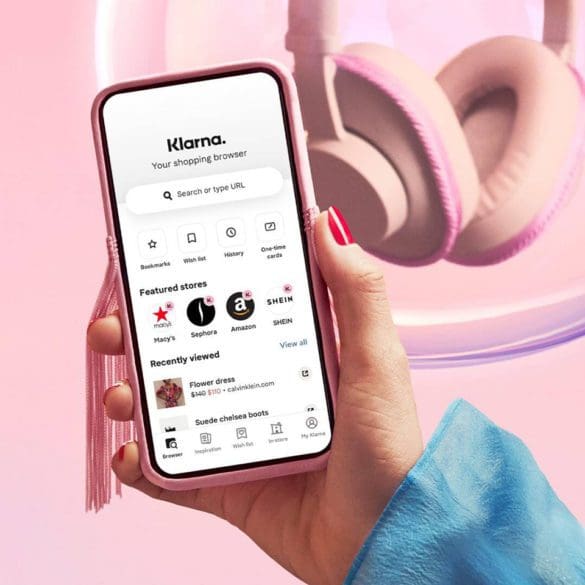

Your feel-good Friday news comes to us from Klarna this week. The Swedish BNPL behemoth appears to be delivering on its promise from 2022 to return to profitability by the end of 2023.

Making fintech news this week were Silvergate Bank, Klarna, Goldman Sachs, Marqeta, LendingTree and more

To be onboarded to the platform, creators simply apply for access here to undergo Klarna's validation process.

The news this week was dominated by the crypto crash as we heard about layoffs at Coinbase, problems at Celsius and a continued downturn in crypto prices. There was plenty of BNPL news as well.

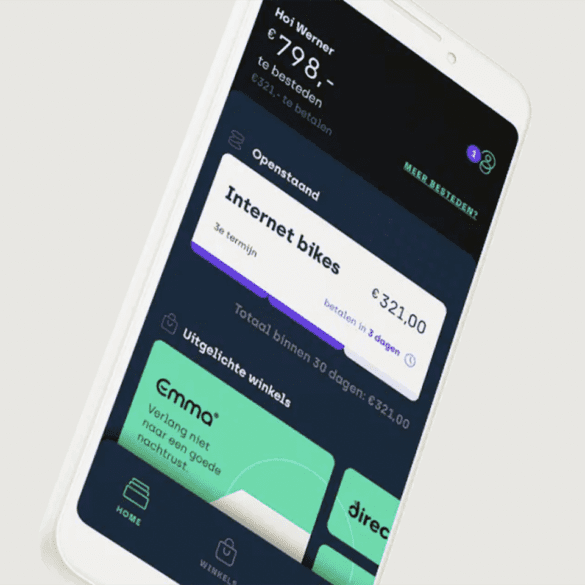

In the Netherlands, BNPL company In3 has been a part of this growth and is now set to expand into other markets.

Despite high interest rates and risks of a reccesion, many BNPL fintech providers now vie to offer loans to the underbanked in Mexico.

With regulation taking center stage, there's an opportunity for banks to take the place of some large BNPL providers and lead the space.

The UK'S HM Treasury has announced regulations for the BNPL sector in response to controversy. Klarna UK Head, Alex Marsh, responds.

Buy now, pay later (BNPL) giant Klarna will start reporting data on customers' usage of its products to credit bureaus in the UK.

How did competition between the top consumer debt contenders heat up over the long-awaited holiday shopping spree?