As the sparkling firecracker news of acquisitions, plans, and partnerships in the BNPL space fizzle, oversight reporting has sprung up. A Credit Karma survey found that of those who used BNPL, more than half of the younger crowd missed at least one payment.

Chinadigital lendingeCommerceMetaverse / xRneobanksmall businessSocial / Communitysuper appsupply chain / trade

·This week, we cover these ideas:

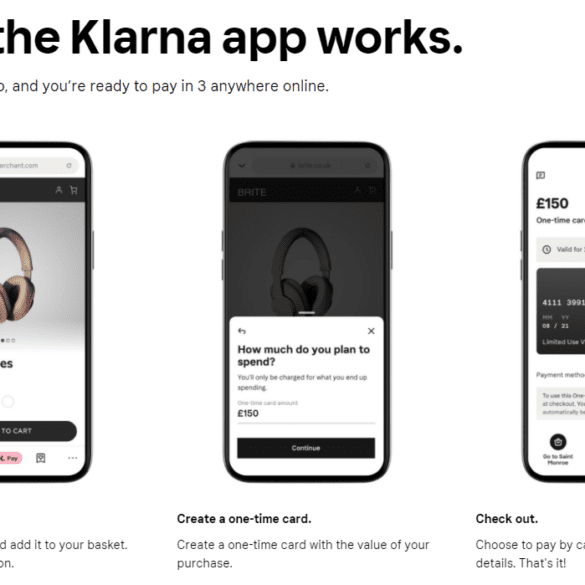

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

This week, we look at:

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

Sweden’s fintech scene has come a long way in recent years and has proved to be one of Europe’s best...

A London-based financial API provider with a uniquely controversial name, Fidel, has established a New York office to add to...

We started the month with the huge news that Square was acquiring Afterpay and we ended with Amazon’s deal with Affirm.

It seems like every day there is more news coming out of this sector, it is white-hot right now.

·

This week, we cover these ideas:

How market structure determines the types of companies and projects that succeed

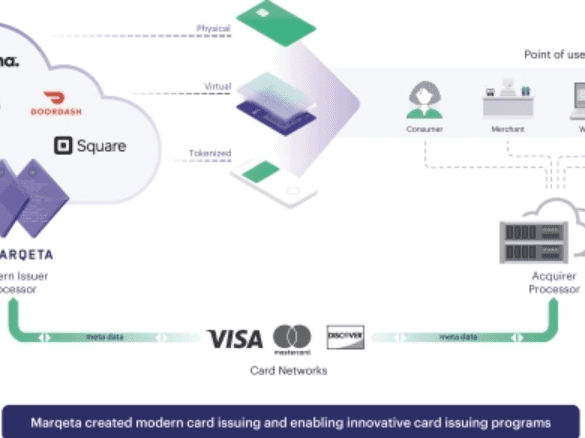

A walk through Marqeta’s economics and business model, and how Square’s Cash App and DoorDash were needed for success

The emerging $10B transaction revenue pool on Ethereum, MEV, and the changes to mining and gas

UK payment aggregator Curve is launching its own credit offering later this year called Curve Credit; they began testing the...

Congress wants to extend PPP, lenders ready to move on Groundfloor Says Q2 was a Record Quarter Broadhaven Ventures’ Michael...

Alibaba’s Ant Group Plans Hong Kong IPO At $200B+ The Startup Movement Is Globalizing: New Report Proves It Global Digital...