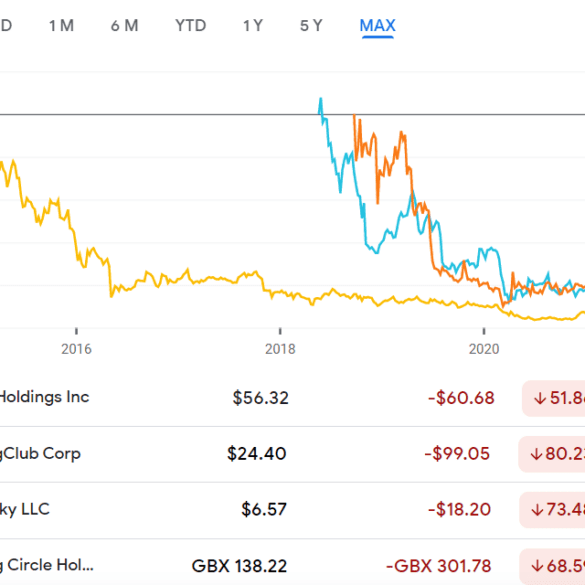

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

Coinbase is going to go public.

The news hit Reuters, then Coindesk, and then the rest of the world. It feels like big news! The crypto broker is beating Robinhood, Acorns, Stash, Revolut, Betterment, and Wealthfront to the public markets. It's even beating SoFi, which is trying to get a national bank license (and who doesn't want to own a bank!).

Lending Works sold to alternative investment manager Global Fintech Funding Declined during COVID-19, Investors Now Focused on Mature Fintechs like...

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

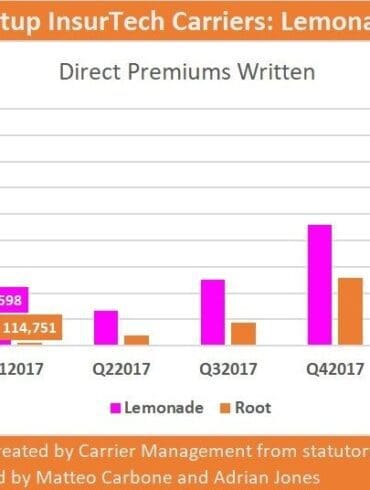

ZhongAn starts trading tomorrow and raised $1.5bn last week, valuing the group at up to $10bn; the IPO has begun pushing insurtech into the mainstream as the company has seen growing interest across the world; the use of AI & big data have been driving forces behind the company and a main reason for investor interest; this might help to give momentum to other insurtech firms like Lemonade and Oscar. Source.

This week, we look at:

PwC estimating that $900 billion has been wasted on digital transformation projects for enterprise, meaning finance is vulnerable

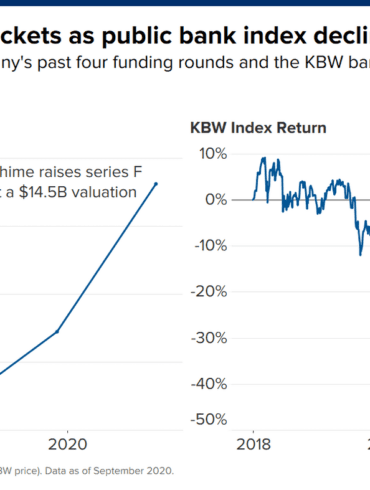

Chime is worth $15 billion in the latest round of valuation, same as $200B+ depository bank Fifth Third, which is quite the achievement

Decentralized exchange Uniswap distributing 60% of its token to the community, flipping the ownership and value accrual model

As a thought experiment -- today, if you want to save for a house, you may create a financial plan in Betterment and wait for the portfolio to accrue. Tomorrow, you may bring cashflows to a housing protocol which intermediates property markets, and build your portfolio directly into your desired goal of buying a house. Your stated selection and articulation of that goal, by choosing the housing protocol, generates value on its own through rewards, participation, governance, and various interest rate products.

Robo 1.0 success Personal Capital was acquired for nearly $1 billion by Empower, a major retirement savings manager. Softbank-backed insurtech darling Lemonade IPOed at less than $2 billion, in a successful fundraise and listing, and has since seen its market cap rise to over $4 billion. The IPO is a landmark for an insurtech industry in desperate need of successes. And PayPal announces the impending launch of crypto trading to its 325 million users. The move isn’t overly interesting in its own right, but the implications for the crypto space are worth exploring.

Insurtech leader Lemonade has filed to go public; the company is backed by an A-list group of venture capitalists including...

Insurtech startup Lemonade announced “We’re opening up the Lemonade platform to the world!” says Shai Wininger, co-founder of Lemonade; the new open API will allow Lemonade to be seamlessly integrated with commerce websites, financial advisor apps, property management companies, payment software processors, IoT [internet of things] platforms and more as Banking Technology reports. Source.

Provides details on announcements from both companies and compares the offerings; PolicyGenius has entered the rental insurance market, launching its rental insurance product this week; also this week Lemonade announced expansion of its rental and homeowners insurance to New Jersey. Source