In part one of this series we explored the interest rate movements at Lending Club over the past year. In this post...

Before the financial crisis the vast majority of the population had never heard of a securitization. But thanks to the...

Lend Academy recently highlighted the trends in interest rates at Lending Club in their recent article; Lending Club has changed interest rates five times since late 2015; the recent trend of increasing rates can be seen in the below chart taken from Lending Club's statistics page which tracks average interest rates across loan grades since 2008; higher risk loans have seen the most impact from recent changes in interest rates. Source

We often get emails from readers asking about the current state of investing with Lending Club or Prosper. Many investors...

Lending Club is offering a bonus for IRA investors; Lend Academy provides details in their article; any investor who opens or adds to an IRA account with at least a $5,000 investment by April 30, 2017 will receive a bonus; bonuses range from $150 to $3,000 for investments from $5,000 to $100,000 and over. Source

Securitization has become increasingly utilized by marketplace lending platforms and in 2016 a record number of deals were done; Lend Academy provides details on securitization structuring, Lending Club's recent securitization and the importance of transparency in their article; in Lending Club's December securitization the total amount of loans in the portfolio was approximately $131.3 million and the portfolio was rated by Kroll Bond Rating Agency. Source

Recent news on consumer lending players IEG Holdings Corporation, OneMain Holdings, Lending Club, Ally Financial and TransUnion is outlined in a press release; of interest is IEG's announcement and offer to purchase all outstanding shares of OneMain and Ally's recent agreement to support contracts from Carvana, an online auto retailer that also operates vehicle vending machines; according to the press release, "Ally will make up to $600 million available to Carvana over the next 12 months through financing and bulk purchases of contracts." Source

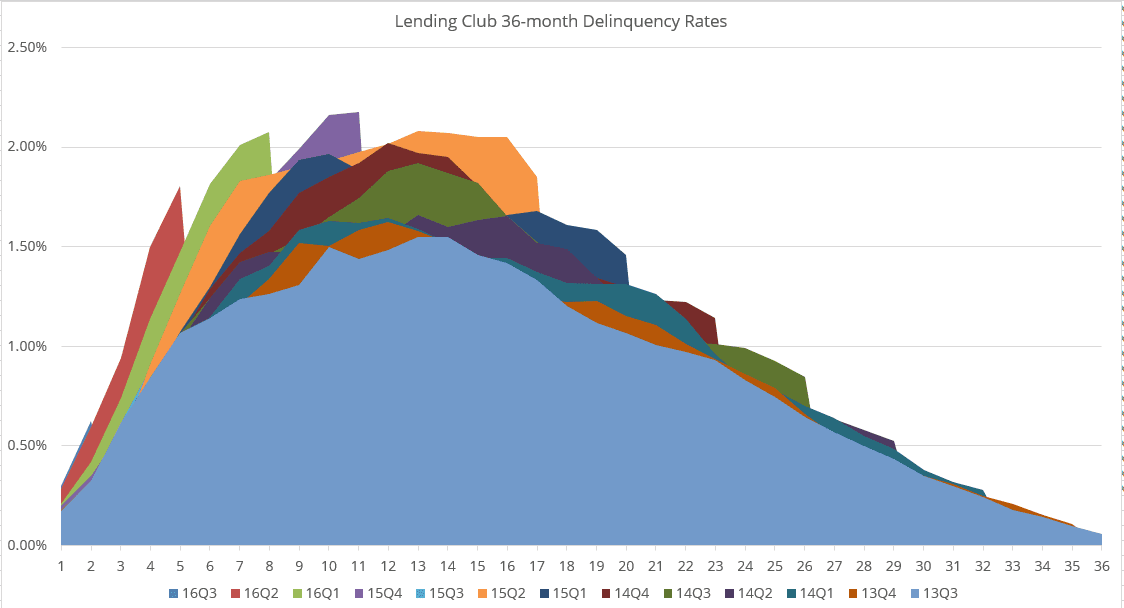

Lend Academy provides insight on online lending performance trends in their article; details interest rate changes and trends from 2010 to present; from 2010 to 2014 returns were relatively stable; in 2015, Lending Club interest rates increased with the Fed's first rate increase in many years however the rate increases were primarily focused on the higher risk loans; capital market investors began slowing investment in 2015 and reduced investments even further after the resignation of Lending Club CEO Renaud Laplanche in May 2016; interest rates at Lending Club have been gradually rising since late 2015, specifically in the higher risk loans; rate increases were put in place to help to offset some degradation in performance; Lend Academy will explore recent vintage performance in part two. Source

Many of us in this industry will be glad to see the last of 2016. It has been a difficult...

If you’ve been thinking about opening up an IRA account with Lending Club, now is a great time to do...