I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

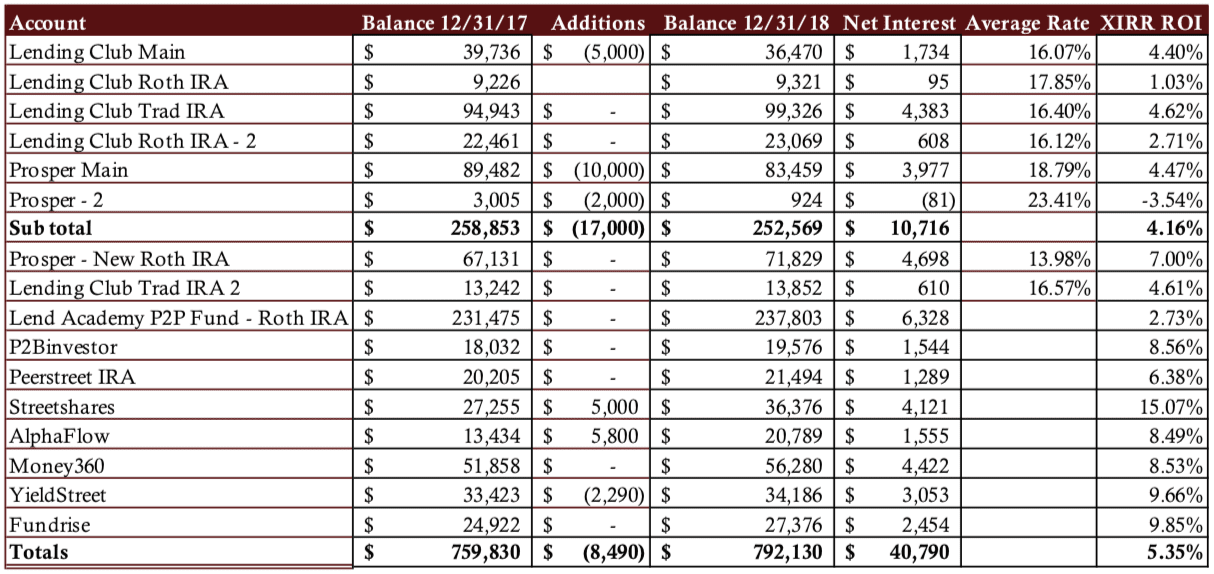

I know I am very late with this regular feature but better late than never as they say. I have...

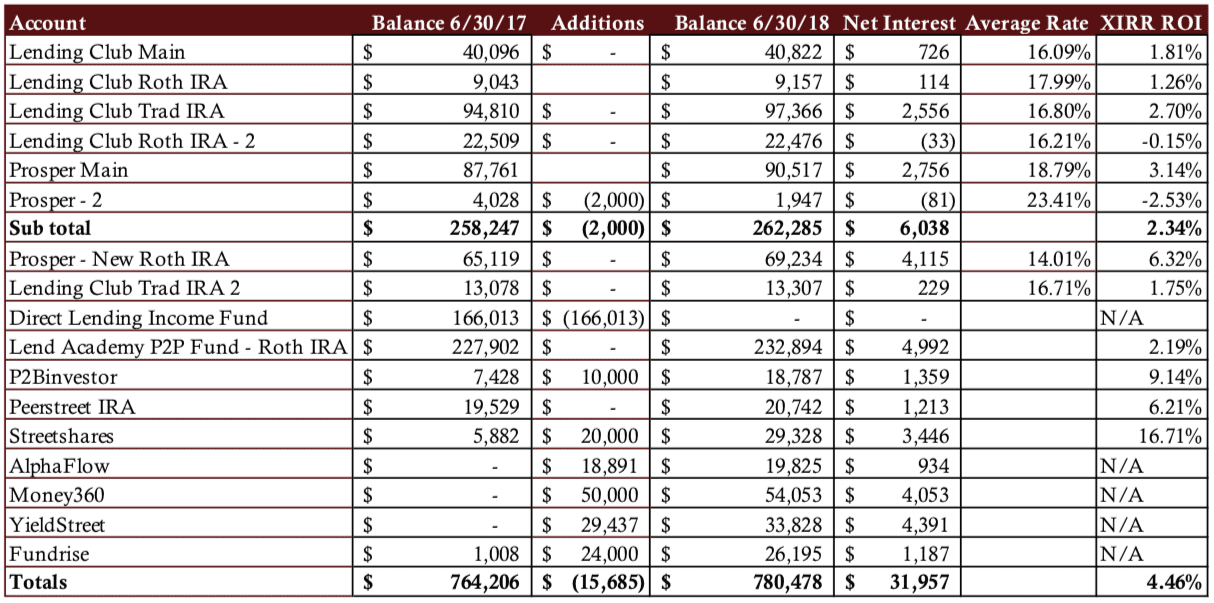

I know I am very late with my update this quarter as many of you have pointed out in emails...

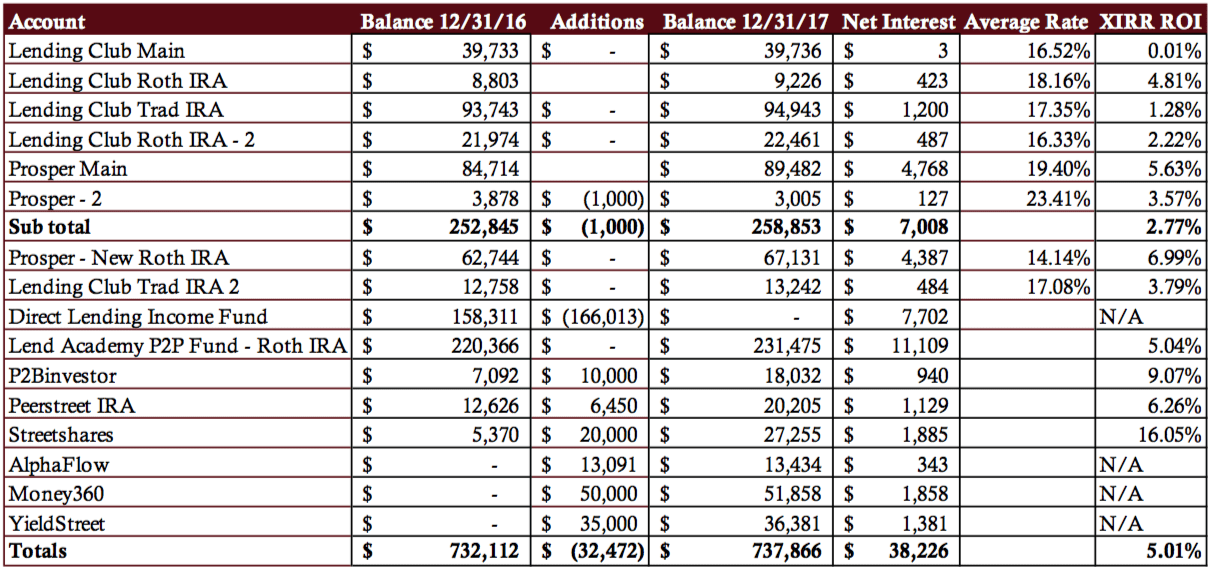

I still remember the day well. It was back in December 2012 when the LendingClub PR people reached out to...

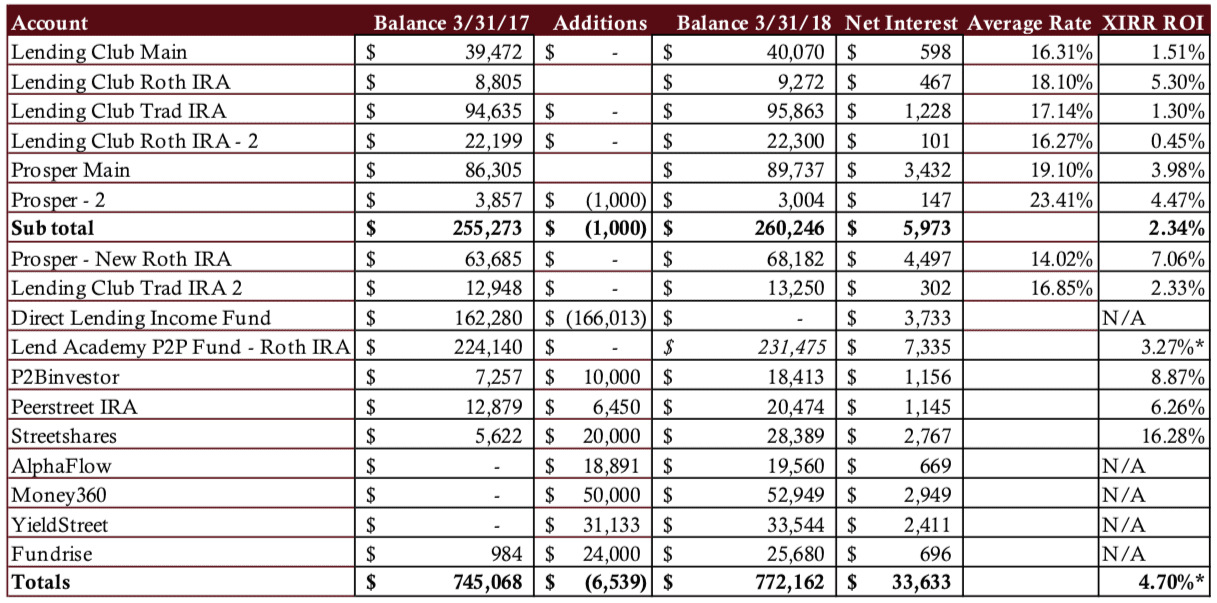

Time for my regular quarterly returns post, one of the most popular features here on Lend Academy. I have been...

[Editor’s note: This is a guest post from Mark Lusky of Mark Lusky Communications, a writing and marketing communications firm, operating since 1982....

Every quarter I share my marketplace lending investment returns with the world. I started doing this back in 2011 with...

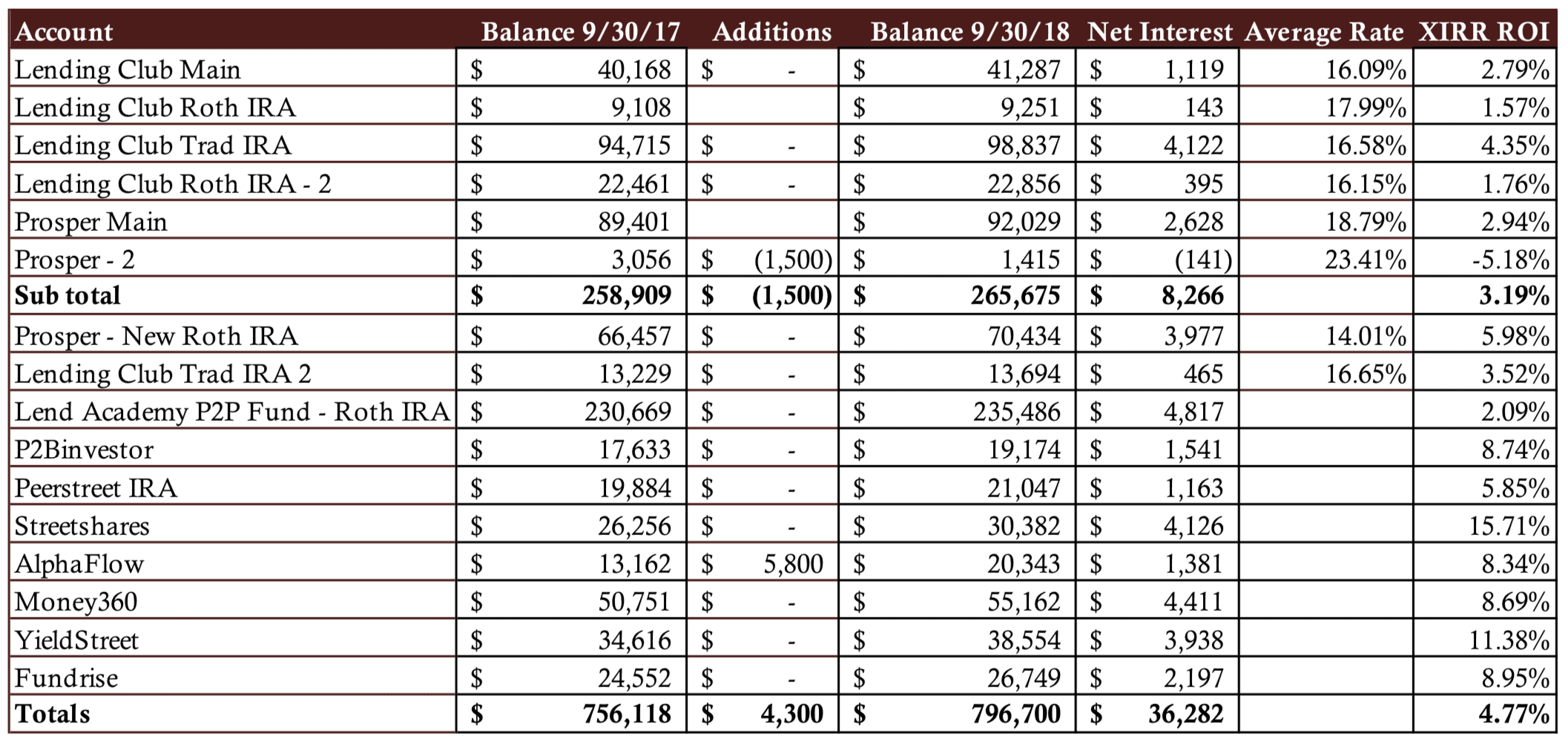

It is that time again when I share my quarterly investment returns. This is something I have been doing for...

In this week’s PeerIQ Industry Update they cover the latest minutes from the FOMC meeting, the new NY Fed report on mortgage lending and Lending Club’s earnings report; the FOMC is on track to raise rates 3 times in 2018 and the new rates could affect ABS pricing; the NY Fed report on the role of technology on mortgage lending said fintech lenders are reducing processing times by 20 percent and default rates by 25 percent; Lending Club reported record revenue and a net loss, their stock dropped 18 percent on the news; PeerIQ also gives a report on their recent partnership with Cross River Bank. Source.

Lending Club files an 8K for a $200mn warehouse funding agreement; JPMorgan Chase was the administrative agent and Wilmington Trust was the collateral trustee; the revolving credit facility will be with certain lenders not yet announced; the move is another step in the funding sources diversification direction the company discussed late last year. Source.