This week’s PeerIQ Industry Update covers 4th quarter GDP news, another round of bank earnings, the new SoFi CEO, fintech fundraising’s and the latest securitization trends; the new SoFi CEO was accepted positively across the market as the company looks to expand products in coming quarters; SoFi and Lending Club are looking at a busy quarter on securitization issuance and PeerIQ reviews their most recent deals; Streetshares secured a $23mn series B round led by Rotunda Capital; PeerIQ also took a deep dive into the key points of the recent letter CFPB Director Mulvaney circulated to staff about his vision for the bureau. Source.

This weeks PeerIQ Industry Update looks at strong job growth despite the hurricanes, Lending Club’s investor day and the latest in securitization; Rep. Patrick McHenry accused the Cleveland Fed, who recently had their p2p lending report retracted, of trying to block the bill entitled Protecting Consumers Access to Credit Act; Lending Club’s first Investor day was not received well by the markets as their stock hit all time lows; PeerIQ reviews the full scope of the investor day including positioning & strategy, product & financial innovation, funding mix, investor returns and stress tests. Source.

While hosting their first investor day the online lender again cut guidance for profits and shares fell to record lows; “The last 18 months have been among the most challenging of my career, but my conviction has never wavered: consumer credit is a data problem that a technology-driven marketplace is well positioned to solve,” CEO Scott Sanborn said at the investor day; Lending Club has had is share of issues and new entrants like Marcus have begun to crowd the market; not all investors are put off by the news, Chinese investor Shanda said he was keeping the faith in the lender as they recently made a big investment. Source.

This weeks PeerIQ Weekly Industry Update covers the power struggle at the CFPB and Lending Club’s new pass through security transaction; a federal judge sided with the Trump administration in the CFPB spat and allowed for Mr. Mulvaney to run the agency for now; Lending Club completed a first of it’s kind deal and in turn will help them to expand the market, lower financing costs, address secondary market liquidity and allows valuation agents to calibrate pricing; PeerIQ also took a deep dive on mortgage delinquencies during the 2008 financial crisis. Source.

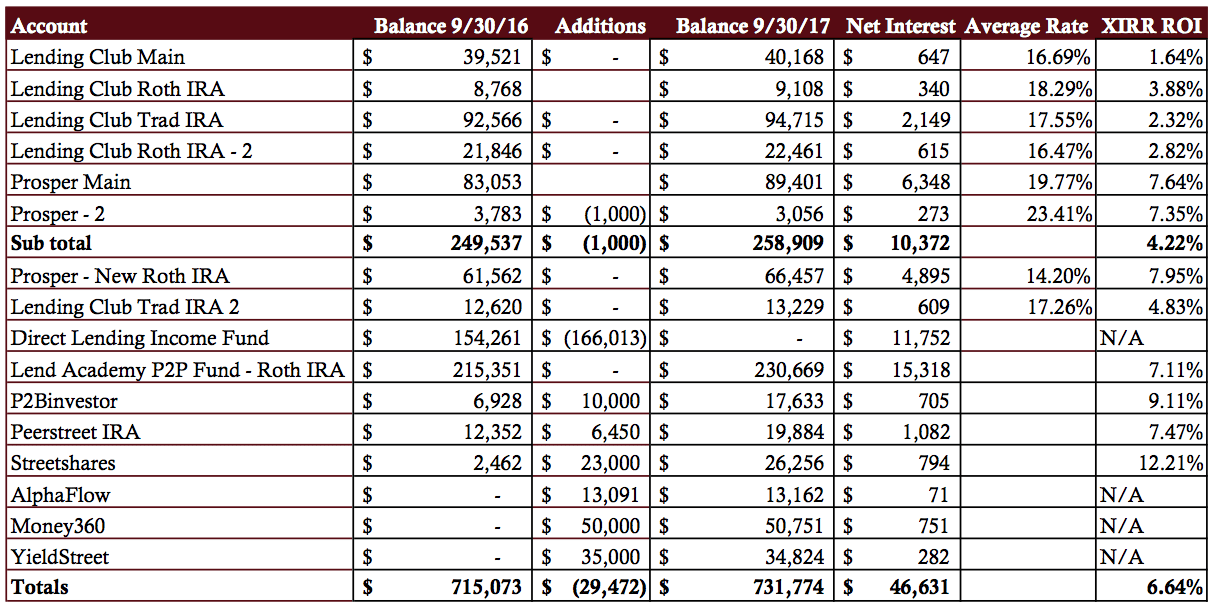

Every quarter I share my marketplace lending investment returns with the world. I started doing this back in 2011 with...

A little over a year ago Goldman Sachs launched their consumer lending platform Marcus as part of a digital strategy...

Last week LendingClub held their very first Investor Day in New York. I was lucky enough to be invited along...

On Friday of last week, LendingClub announced that it closed a new kind of transaction. It was a whole loan...

PeerIQ's weekly update covers the recent partnership by Acorns and PayPal, household debt in the US and a new Bain survey that shows people are more willing to try fintech products; LendingClub filed its latest securitization deal for $330mn and Kroll upgraded all three classes of the Earnest EARN 2016-B deal; they also took a deep dive on TransUnions recently released fintech study. Source.

Shares in the online lender have sunk almost 20 percent on news that they will lower their full year earnings forecast; the company also announced that they are limiting lending to lower grade borrowers as they continue to tighten their credit standards; while scandal has hurt the company, they have been tightening their credit standards for close to two years as they continue to adjust models. Source.