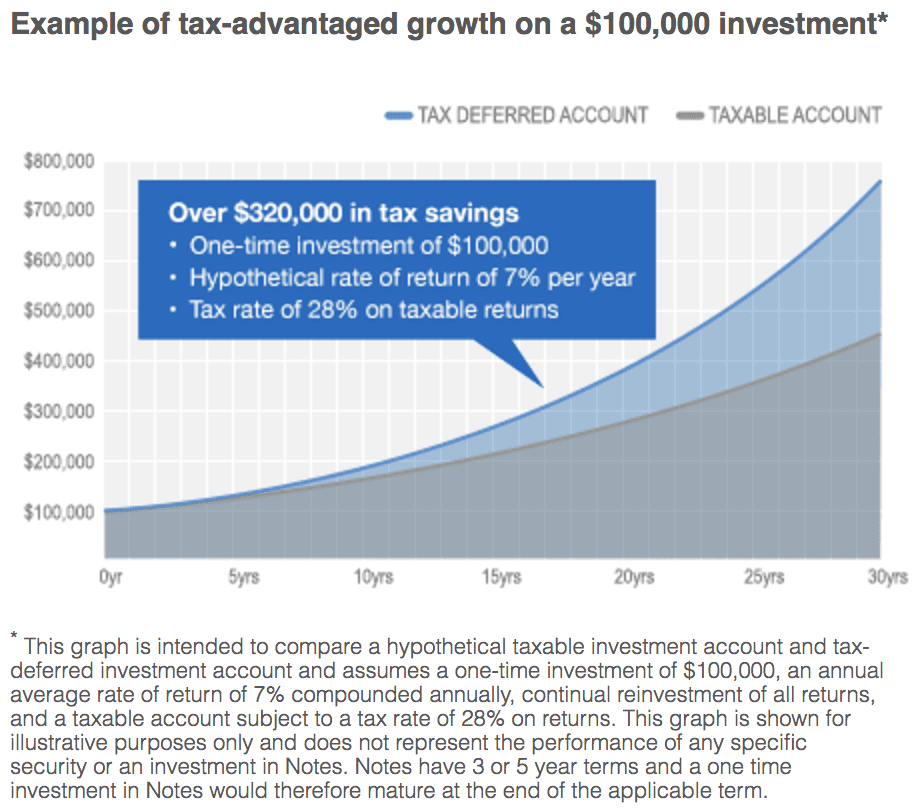

Lending Club and Prosper allow for tax efficient investing on their platforms through an IRA; Lend Academy provides details on opening an IRA with Lending Club or Prosper and explains why investing in P2P lending is best done through an IRA. Source

Scott first looks back at 2016, how Lending Club was able to overcome adversity and highlights some of the leading lenders in the space like SoFi and OnDeck; he makes the comparison that online lending is a lot like online retail and there are many lessons to be learned; just like customers in retail the customers in banking do not want to go to the local branch to get a loan, they want to have a seamless digital experience like they already have with the likes of Amazon; Scott offers three ideas to define the next decade for a stronger industry, evolve the customer experience, unleash the platform's potential and amplify the core innovations that serve customers; he finishes up with a few questions from audience members. Source

[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. This post shares how Lending Club...

Scott Sanborn provided the opening keynote presentation at LendIt USA 2017; the appointment of Sanborn has been a critical success factor for Lending Club and the marketplace lending industry; in his presentation he discusses the challenges of 2016 and the significant growth opportunity that still remains ahead; compares the market's potential to the growth of Amazon; provides insight on important factors for growth over the next ten years.

Scott Sanborn discussed the current market environment for online lending in his speech at LendIt USA comparing the industry to the growth of online retail and using Amazon as an example for how businesses can dramatically change and adapt to provide the best services for market needs; online lenders will have to be strategic in identifying market opportunities, building on their proprietary systems and partnering with other companies; Ash Gupta from American Express also noted at the conference the challenges and opportunities presented to online lending through the use of big data; the growing amount of data sourced by the industry has the potential to improve credit models and fraud prevention while also providing broader capabilities through machine learning technology. Source

The April 18, 2017 tax deadline also marks your last chance to fund a new traditional IRA or Roth IRA for 2016. Both...

Lend Academy provides details on the tax documents you will receive as an investor in Lending Club or Prosper loans; most investors will receive a 1099-OID which details taxable interest income from investing; other forms may also include a 1099-MISC or a 1099-B; income earned from P2P loan investing is taxed as ordinary income; Lend Academy also outlines details on capital losses and capital loss carryovers which can vary by state. Source

Scott Sanborn gave a recap of his LendIt USA 2017 keynote presentation and reiterated his excitement and positive outlook for the marketplace lending industry in a blog post; Sanborn identified three key areas of importance: evolving the customer experience, unleashing the platform potential and amplifying core innovations; with a focus on these three things Lending Club plans to see more borrowers and investors as well as a number of new and innovative partnerships fueling its future business growth. Source

The market has reported the first securitization of Lending Club prime loans, the Arcadia Receivables Credit Trust (ARCT 2017-1); the portfolio has been priced by Jefferies and is backed by $220 million of Lending Club prime loans as collateral; the loans come from Cirrix Capital's marketplace lending fund which is overseen by Arcadia; the securitization has two tranches which have both received a rating from Kroll Bond Rating Agency; tranche A includes the majority of the loans with $176.9 million in collateral and a BBB rating; tranche B includes $36.75 million in loans with a BB- rating; PeerIQ provides further analysis on the portfolio and how it compares to other similar securitization deals. Source

Lending Club borrowers are given a 15 day grace period for loan payments; borrowers are not assessed a late fee and previously did not pay accrued interest on the overdue amount; Lending Club has revised its grace period policy as of February 24 to require borrowers to now pay additional interest on the late payments; the firm will continue to not charge a late fee until after the 15 day grace period. Source