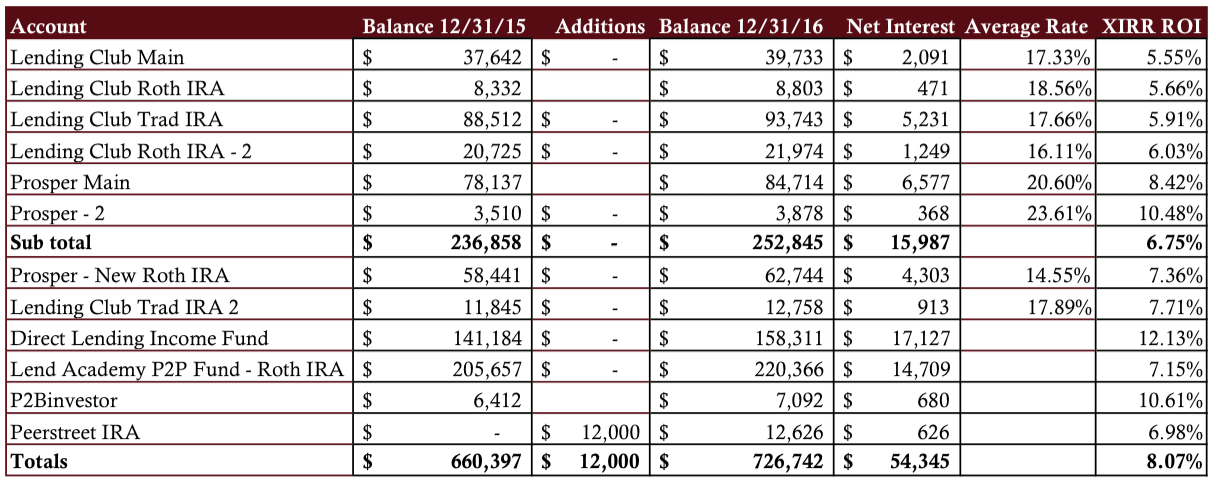

Regular readers know that this is one the most popular features on Lend Academy. I have been sharing my detailed quarterly...

The chart below shows the stock performance for Lending Club versus OnDeck since May 16, 2016, which is the day Lending Club's stock bottomed out after their CEO resigned; Lending Club is up 64% and OnDeck is up 8%; both companies have taken a hit this week after earnings, largely due to profit taking.

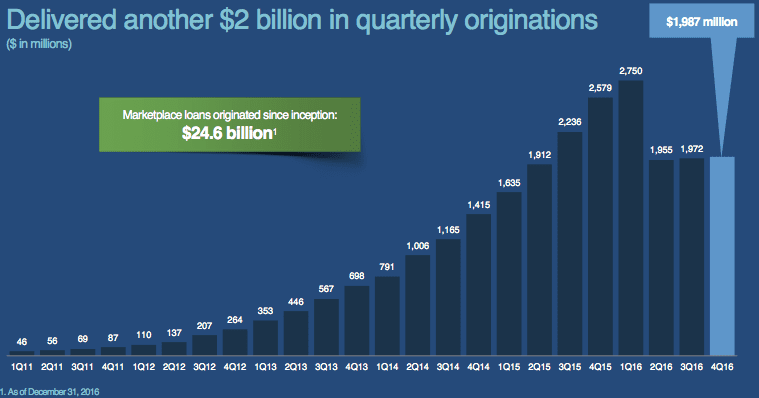

Lending Club has released their Q4 2016 and 2016 year-end results. The company originated $1.987 billion in loans, up 1%...

A federal district court in the Southern District of New York has ordered the Bethune v. Lending Club Corporation, et al. case to proceed to arbitration; plaintiffs argue that Lending Club loans were in violation of state usury laws despite their association with WebBank; while the case is still pending, the court has said it will be decided through arbitration due to clauses in place by Lending Club. Source

Morgan Stanley Analyst James Faucette says Lending Club has upside potential of 35%; cites institutional investment, loan growth at moderate but sustained pace and industry contacts reporting no deterioration in reinvestment or retention rates; targets the stock at $8; the company will announce Q4 and year-end earnings on February 14th. Source

Lending Club's fourth quarter earnings release showed a decrease in investment from retail investors; the decrease follows an increased focus from the company on banks and institutional investors as the company seeks to regain credibility following issues in 2016; while originations have remained fairly steady over the past three quarters, the percentage of investment from institutional investors increased to 74% in the fourth quarter. Source

Lending Club released its fourth quarter and full year earnings results on Tuesday, February 14; Lend Academy provides details of the earnings release in their article; the lender originated $8.6 billion in loans for 2016; net operating revenue for the year was $495.5 million, up from $426.7 million in 2015; net income fell to -$146 million from -$5 million in 2015; banks increasingly returned to the platform in the fourth quarter of 2016 funding 31% of loans, an increase from 18% in the third quarter. Source

According to a report from GlobalCapital, Jefferies and Lending Club are partnering on a new securitization for Arcadia Funds; the portfolio is expected to include approximately $300 million of prime consumer loans from Lending Club. Source

John MacIlwaine has taken a new role as chief technology officer at Braintree; Braintree is a mobile payments technology company owned by PayPal; MacIlwaine submitted his resignation at Lending Club in December. Source

Lend Academy provides details on how marketplace loans are performing at Lending Club and Prosper; delinquency rates have been increasing since the third quarter of 2014; less risky loan grades have continued to report the best performance; lower quality loans have suffered increased degradation specifically since the third quarter of 2014; Prosper has made fewer interest rate changes than Lending Club and it seems its higher risk loans are performing slightly better; Lending Club announced additional changes to the platform on January 18th. Source