LendingClub saw revenue and earnings at the high end of their guidance range but, due to ongoing uncertainty remain reserved with next steps.

After a successful first quarter, LendingClub posted earnings of $.39 a share on revenue of $289.5 million, beating analysts' expectations.

Eric Satz soon realized there was a problem. The year was 2014 and he was trying to use his IRA...

We knew this was coming and this afternoon LendingClub has released the details of its Founder Savings Accounts for individual...

The last day of the year is normally pretty quiet as far as news goes but LendingClub had two major...

When Scott Sanborn signed up, the topic exercised his expertise: how did LendingClub build a digital marketplace bank. Then, things changed.

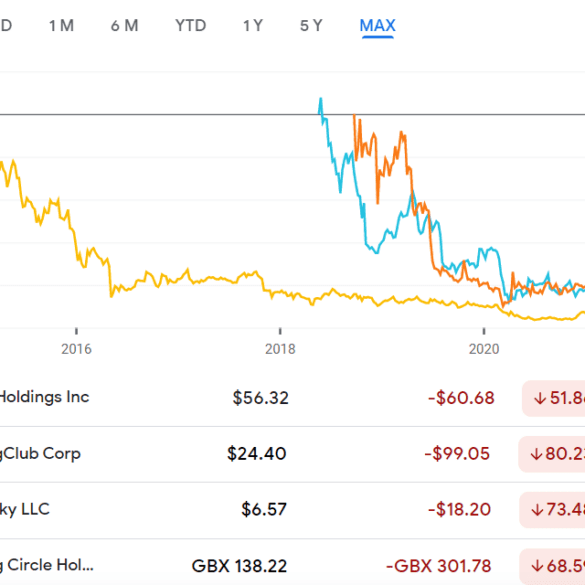

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

LendingClub reported Q4 earnings today and their recovery from the depths of the pandemic continues. Loan originations were up 56%...

That was quick. After receiving preliminary approval from the OCC on December 30, LendingClub announced today that they have now...

As the sun sets on 2020 and we look back at this past year nearly everything is viewed through the...