We are winding down the year and approaching the time when the news cycle starts slowing down and everyone begins...

Peter Renton shares returns from his marketplace lending portfolio as of Q3 2017; overall returns for Renton’s portfolio was 6.64%; declining performance in the portfolio is primarily due to LendingClub loans; new additions to his portfolio for the quarter include AlphaFlow, Money360 and YieldStreet. Source

A recent post on the Lend Academy Forum spurred a discussion about the potential future of LendingClub, particularly as it...

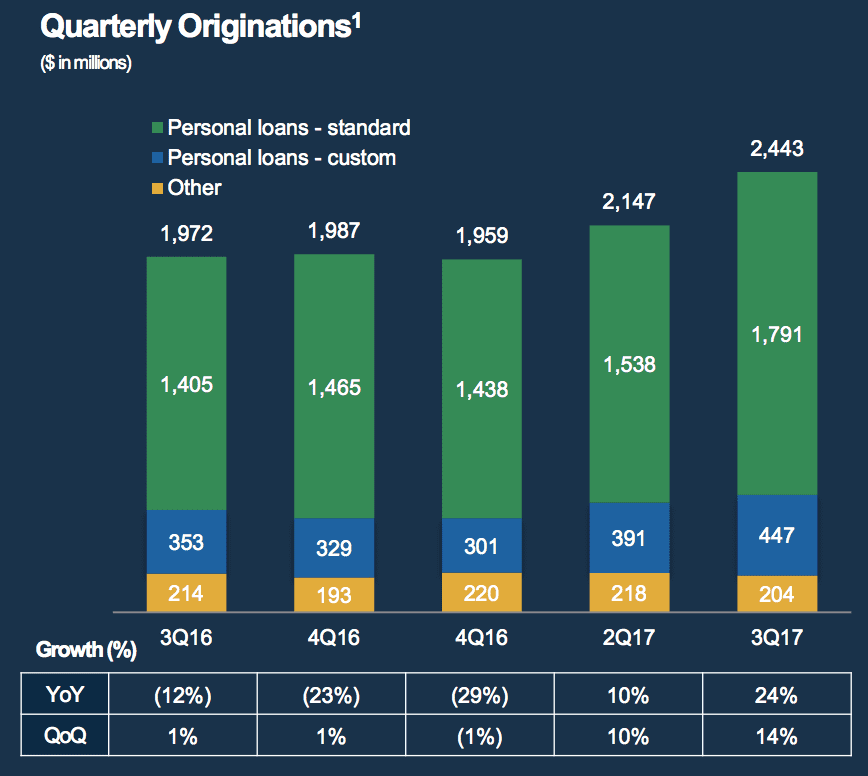

Last quarter we reported that LendingClub had returned to origination growth. It was a relatively small amount, compared to historical...

The lawsuit according to Crowdfund Insider names former CEO Renaud Laplanche along with current and former board members as well as former CFO Carrie Dolan; according to the complaint: "Throughout the period December 11, 2014 and continuing through May 9, 2016 (the "Relevant Period"), the individual defendants breached their fiduciary duties to LendingClub by failing to institute adequate internal controls regarding financial disclosures, related party transactions, and data integrity and security, all while causing LendingClub to represent in the Registration Statement and a series of subsequent filings that such controls were sufficient."; two shareholders filed the suit. Source

Last week LendingClub closed a whole loan transaction structured as a tradable, pass-through security called a CLUB Certificate; Lend Academy reached out to LendingClub to find out more and shares what benefits this structure has for some investors. Source

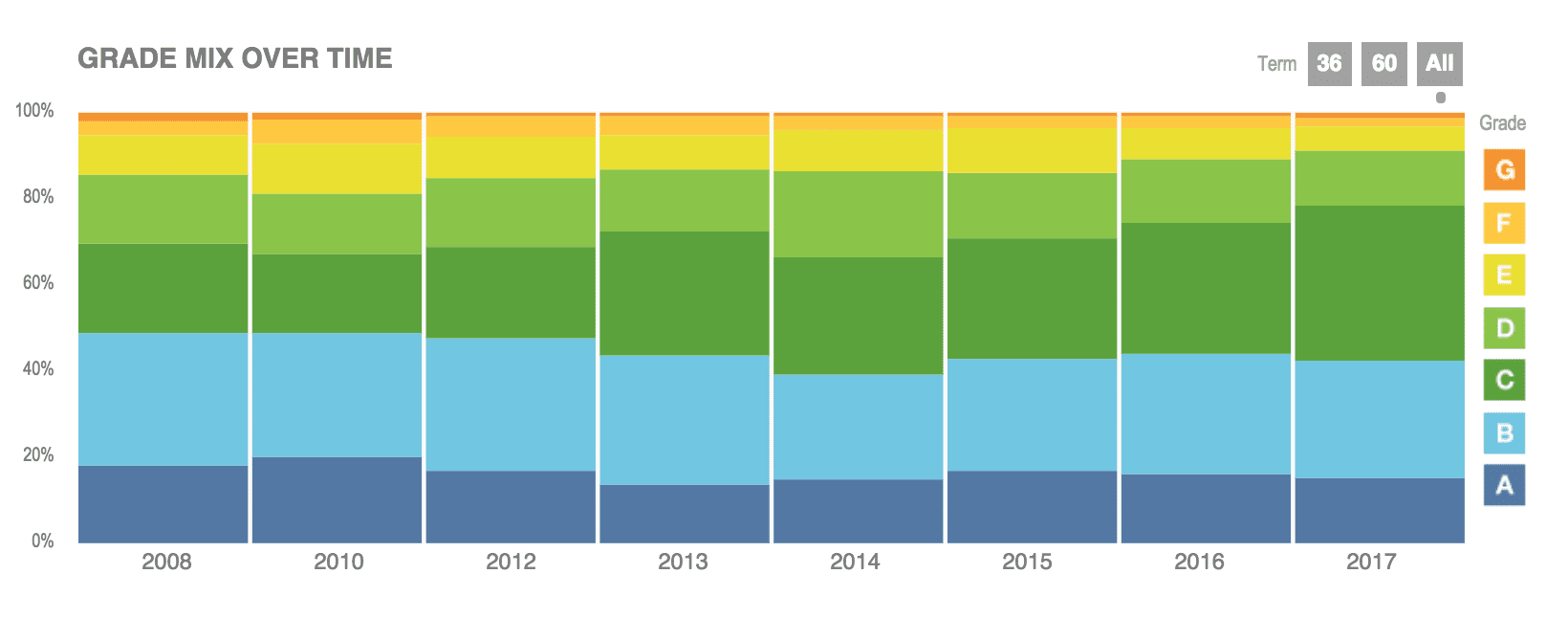

Lend Academy looks at the shift of returns and interest rates at LendingClub; the company recently brought F & G loans in house and there is a noticeable shift in loan grades offered by the platform. Source

Yesterday LendingClub released their Q3 earnings; they originated $2.44 billion in loans, up 14% from the previous quarter; revenue was on the lower end of projections, but the company had a lower GAAP loss than expected; Lend Academy shares other highlights from the earnings call. Source

Lending Club has closed five of its investment funds under LC Advisors; the loans have been sold off to various buyers and the company has rebranded its investment management business to LendingClub Asset Management. Source

Scott Sanborn talks with Bloomberg about LendingClub's recovery and Q217 results; says the firm has focused on internal controls and investors; highlights that 44% of loan funding in Q2 came from banks; also discusses competition with credit cards and the consumer credit market. Source