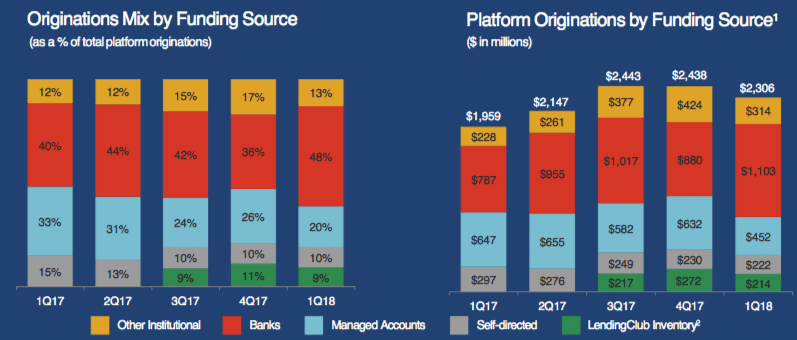

Banks make up nearly 50% of LendingClub’s platform as originations grow 18% year over year; originations were $2.3 billion for...

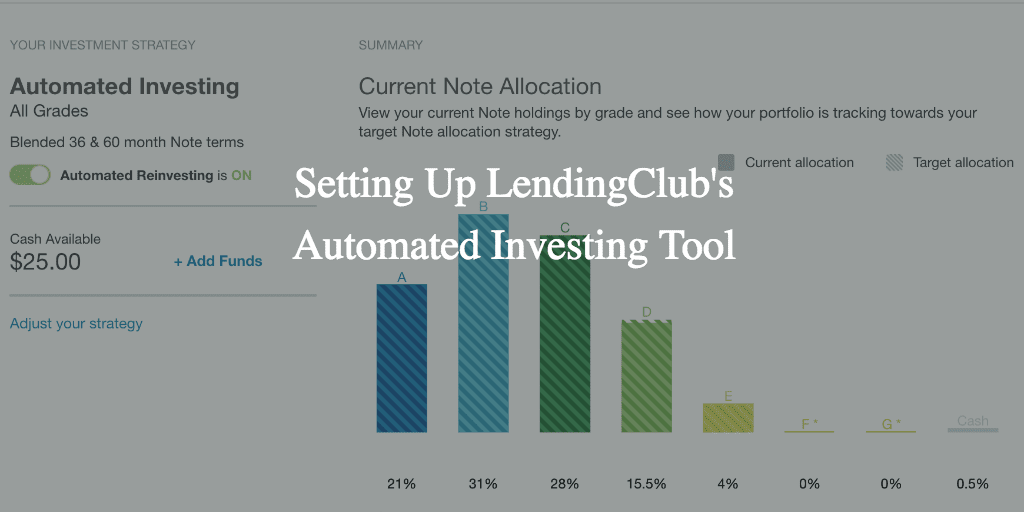

LendingClub has recently updated the way users can setup automated investing within their account; Lend Academy’s post and accompanying video...

The complaint stated that LendingClub violated federal laws which protect consumers from unfair and deceptive practices; LendingClub stock price dropped on the news which related to LendingClub’s promise of no hidden fees and a statement to applicants that “Investors Have Backed Your Loan” even though borrowers may not have been approved; some borrowers also experienced overdraft fees when LendingClub withdrew double payments according to the complaint. LendingClub responded to the complaint by issuing a press release. Source

Peter Renton, the Founder of Lend Academy opened his first LendingClub account in mid-2009. I opened my first LendingClub account...

The former Treasury Secretary is being replaced by Stanford Economics Professor Susan Athley. Source

During the first quarter, LendingClub is typically affected by the seasonality of the lending business so it’s beneficial to look...

In our last post and accompanying video we outlined how to setup a LendingClub account in 2018. One of the...

In this post we share the process of opening up a new LendingClub account, the first in a new series we will be sharing over the coming quarters. Source

The settlement totaled $2 million with a Massachusetts banking regulator stemming from claims of making unlicensed loans; LendingClub made over 46,000 loans in the state since 2011 after surrendering their small loan company license; according to a LendingClub spokesperson, “We worked cooperatively with the State of Massachusetts to resolve a licensing dispute. Resolving this is another step in putting the legacy issues behind us and moving forward to concentrate on building the business. There will be no disruption to any operations as a result of this resolution, and we look forward to continuing to provide attractive financing opportunities to residents, patients and students in the State of Massachusetts.” Source

The report is titled “Do Fintech Lenders Penetrate Areas That Are Underserved by Traditional Banks”; the report used account-level data from LendingClub and other US Banks with assets over $50 billion; according to the paper’s abstract: “We find that LendingClub’s consumer lending activities have penetrated areas that may be underserved by traditional banks, such as in highly concentrated markets and in areas that have fewer bank branches per capita. We also find that the portion of LendingClub loans increases in areas where the local economy is not performing well.” Source