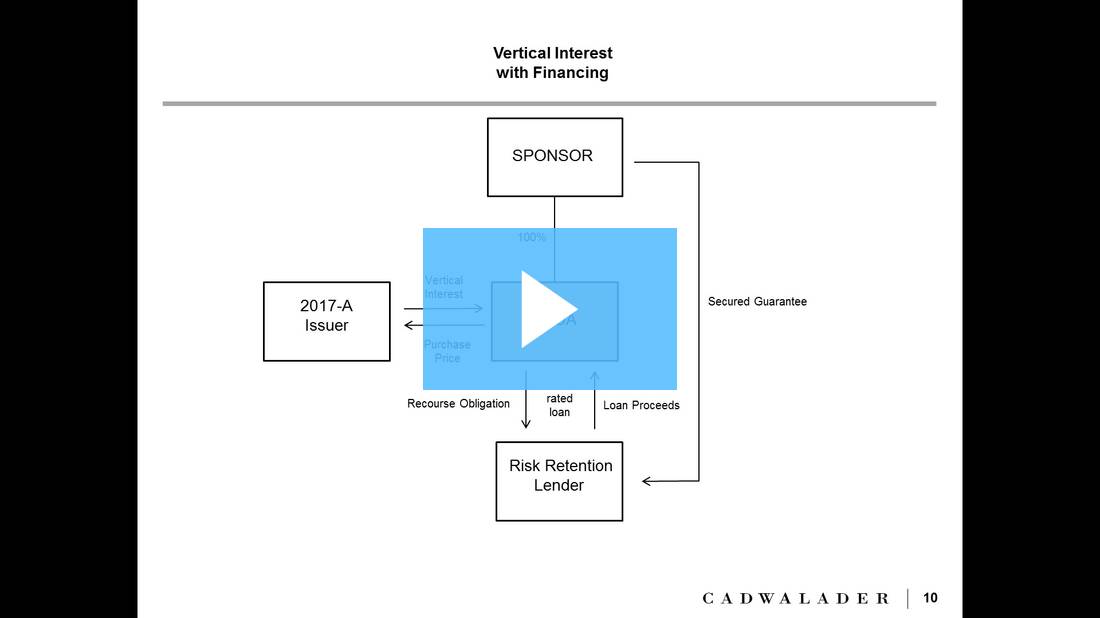

LendIt's most recent forum, Key Considerations for Risk Retention in Securitization, was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers provided insight on a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned-affiliates; a replay of the webinar is now available.

LendIt, in conjunction with Cadwalader and Lending Times, will host a forum on securitization this Wednesday, January 11th at 2:00 PM EST; the webinar will focus on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements necessary to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and other related topics; speakers include Philip Bartow of River North, Bruce Bloomingdale from Cadwalader, Wickersham and Taft, Rupert Chisholm from One William Street Capital, Abe Kahan of CommonBond, Dylan Schuler of CommonBond and Gregg Jubin from Cadwalader, Wickersham and Taft; learn more by registering here today.

In the fintech industry there are many companies that have emerged with food-based company names; as the holiday season ends and the new year begins, LendIt has highlighted these companies in a blog post; the list of companies spans the full range of fintech industry categories. Source

At LendIt we are always looking to improve our conferences from year to year and part of that is adding...

·

Peter Renton started off the day by announcing the winners of our second annual PitchIt @ LendIt competition. In the...

LendIt will be hosting a forum today on risk retention in securitization at 2:00 PM EST; the forum will be held in conjunction with Cadwalader and Lending Times; speakers will provide insight on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements necessary to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and other related topics; register here and join the webinar today.

Securitization continues to be a key source of capital for many marketplace lenders; LendIt, in association with Cadwalader and Lending Times, will host a forum on Wednesday, January 11th at 2:00 PM EST; the webinar will focus on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and more; register today.

In our recent blog post we outline our three audiences in the USA, Europe and China; all of our global fintech conferences highlight the most innovative companies from around the world; at our March LendIt USA conference we are expecting 5,000 attendees in New York City with participants from over 40 different countries; we encourage our international attendees to book their travel plans early; read more about our global audiences in our blog post and contact LendIt to answer any questions you may have about international travel plans or visa letters. Source

·

LendIt USA 2017, the world’s biggest show in lending and fintech, will kick off for the 5th year on March...

·

Day 1 of LendIt USA kicked off for the fourth year with the CEO of Lending Club, Renaud Laplanche giving...