The CEO and Co-Founder of Stratyfy, Laura Kornhauser, discusses how advanced AI underwriting models are now becoming more widespread in the banking system.

·

If a financial institution looks beyond the hype of AI and tempers its expectations, it can use AI to deliver measurable business results. That’s been the experience of Amount’s director of decision science Garrett Laird.

Cion Digital's new Advisor Lending Platform connects wealth professionals and firms with lenders in a more efficient process than was previously available. They also now offer their product suite to a more significant portion of the financial services and retail sectors.

As underwriting turns toward AI, experts agree if credit solutions have a hope of meeting their potential, alternative data is vital.

A new report published by Backbase and IDC says the APAC region is set for a dramatic increase in adoption...

Banks use relationship-based services to attract and retain customers in these times of higher interest rates. SunTec Business Solutions President Amit Dua said if these services are correctly deployed, they benefit both the bank and the customer.

Everyone is talking about how AI is the next big thing, and there is no doubt it is making waves. But is the world ready?

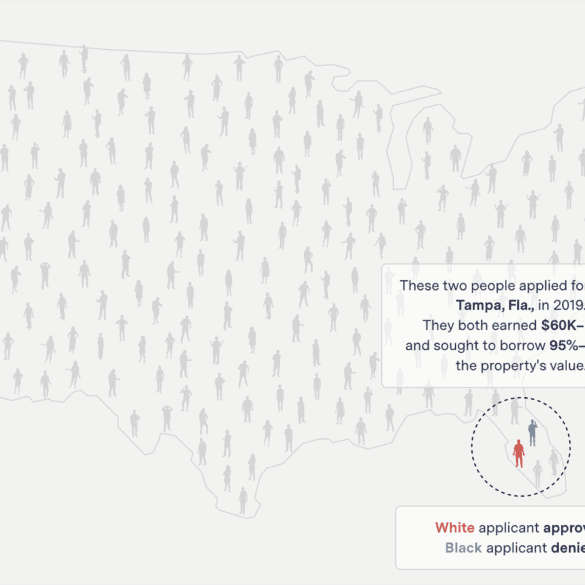

Bias in credit underwriting is an issue some worry will be exacerbated by AI others believe it is the only way forward. At Fintech Nexus USA 2022, approaches were discussed to mitigate concerns.

Nav announced a partnership with Marcus by Goldman Sachs to offer SMB owners lines of credit through machine learning on the platform.

The Cambridge Centre for Alternative Finance is a leading provider of research and reports on fintech across the globe; their...