Machine learning and predictive analytics have started to make a real difference in the VC world when it comes to finding investments; VC’s typically traveled a lot and met with thousands of companies to find a few investments; by using machine learning to break down troves of data, like job postings or performance in the App Store, investors can find potential gems without the same laborious effort; VC firms are investing in tools to help them refine searches and comb through thousands of companies quickly; increased computing power and cheaper ways to rent server capacity has really helped VC’s, even the small firms, use these techniques every day. Source.

A new report from Numis entitled The State of AI in 2017 explains the potential AI and machine learning for wealth managers; as AltFi reports, “AI enables asset managers to deliver to the mass affluent a degree of personalisation and service quality previously reserved for high net worth clients.”; the technology can also help to improve quality, decrease cost and help to make most of the asset management industry into robo advisors. Source.

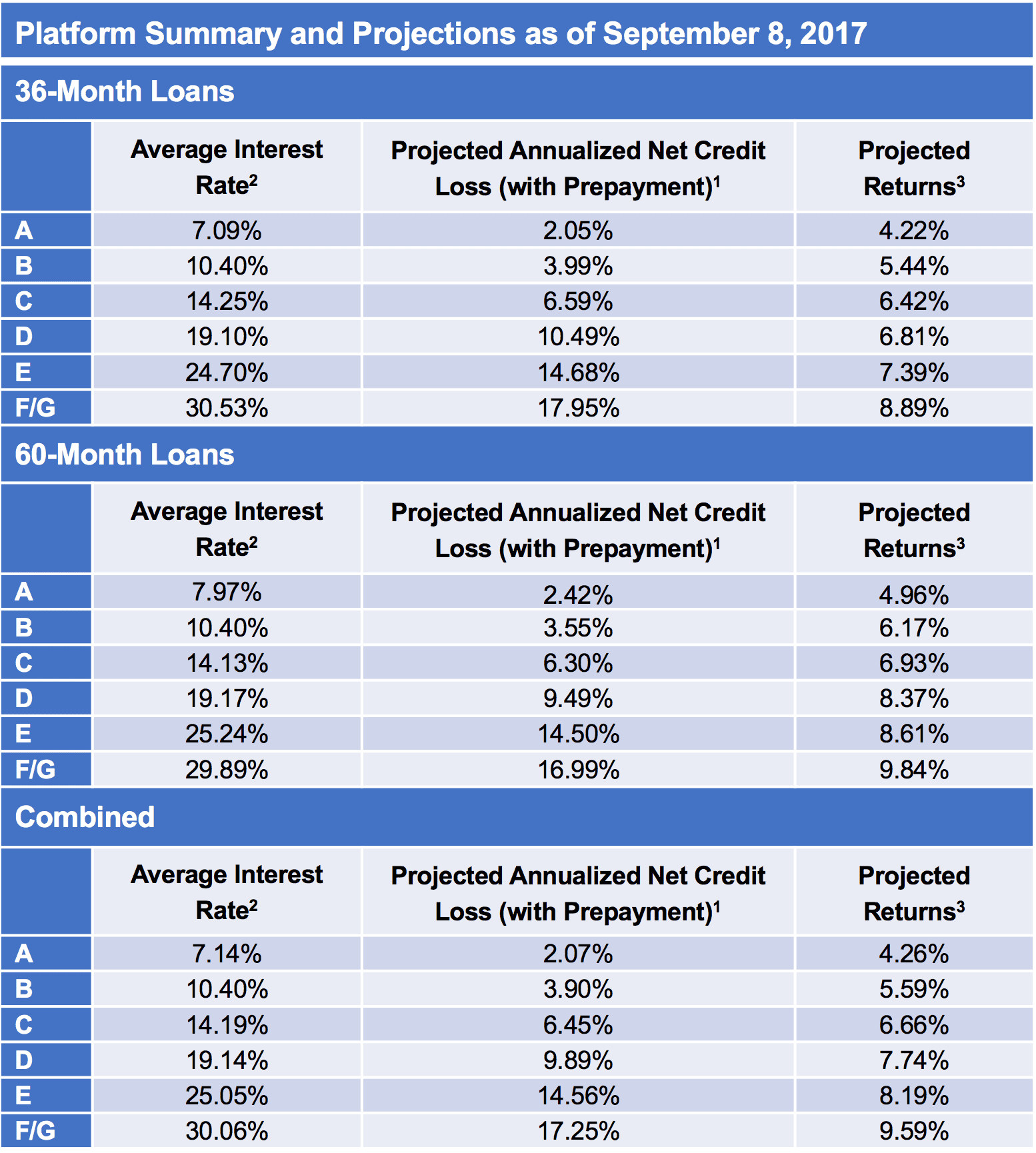

Today, Lending Club announced a new credit model in an email to investors. According to the email, this is the...

Editor’s Note: This is a guest post from Marc Stein, CEO at Underwrite.ai and Principal at Artificial Intelligence Capital Management....

Simility, a machine learning adaptive fraud prevention product, raised $17.5mn from PayPal, The Valley Fund and Trinity Ventures; the company helps to prevent fraud and abuse in real time using machine learning and big data analytics; Rahul Pangam, Co-Founder and CEO of Simility, tells Crowdfund Insider, “Digital disruption in the financial and commerce sectors has resulted in the need for a fraud and risk management solution that goes beyond legacy.”; the company plans to build out data science teams and continue expanding globally. Source.

Personal credit and financial management firm Credit Sesame raised $42mn in equity and venture debt; investors include Menlo Ventures, Inventus Capital, Globespan Capital, IA Capital and SF Capital; the capital will be used for growth, hiring, customer acquisition and to build out their machine learning technologies. Source.

I first wrote about Peerform way back in 2010 when they began life as Lendfolio. Even though they are not...

Artificial intelligence (AI) and machine learning are becoming increasingly relied upon by financial services companies and the credit sector; the algorithms powering these solutions have also advanced the use of AI and machine learning; while these advancements have helped new solutions they have also created new risks; these risks are primarily focused in three phases: input, training and programming; risks can also be higher when using nontraditional data; a report from White and Case titled, "Algorithms and Bias: What Lenders Need to Know" provides details on the evolution of algorithms in artificial intelligence and machine learning and explains important factors to consider for credit providers. Source

No More Content