Harit Talwar, the head of Marcus since joining Goldman Sachs in 2015, is in the running for one of the...

JPMorgan Chase is currently in discussions with UK regulators about launching a digital bank in 2020; the new bank is...

Consumers have plenty of options when it comes to financial services; despite the success of fintechs around the industry, some...

The Financial Brand looks into the new data gleaned from the recent Goldman Sachs investor day and concluded that their...

The long time secretive bank is now opening up on future plans in an effort to win over investors. Today,...

I examine the unbelievable transformation and restructuring happening in high finance. Global bank HSBC is planning to lay off over 10% of staff, looking at reductions of 35,000. E*TRADE is being acquired by Morgan Stanley, integrating its 5,000,000 accounts and $360 billion of assets into the Wall Street investment firm. Legg Mason and its $800 billion of assets are being folded into Franklin Templeton for $4.5 billion, less than what Visa had paid for fintech data aggregator Plaid and half of what Robinhood is likely valued privately. How do we make sense of these developments? How do we appeal to the heart?

According to a survey by Cornerstone Advisors 8.2 percent of respondents said they will open a checking account with Marcus...

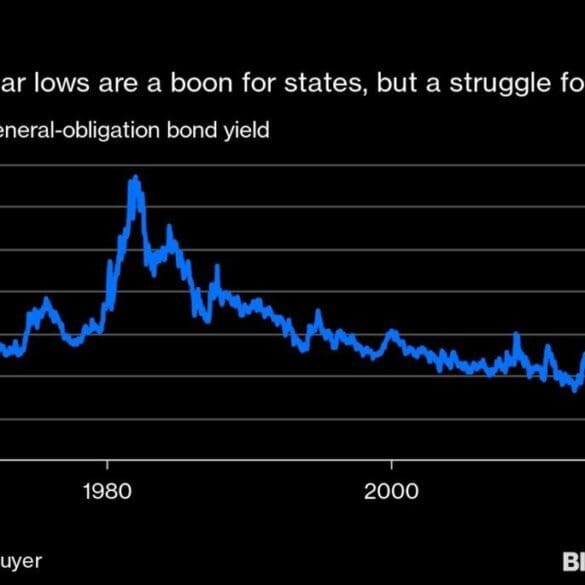

I reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

Goldman Sachs held their investor day yesterday, opening up about their future plans; the bank has not been shy about...

It took three years for Marcus to bring a mobile app to market which many would agree is a long...